Bankruptcy Forces Ice Cream Chain to Close 500 Locations

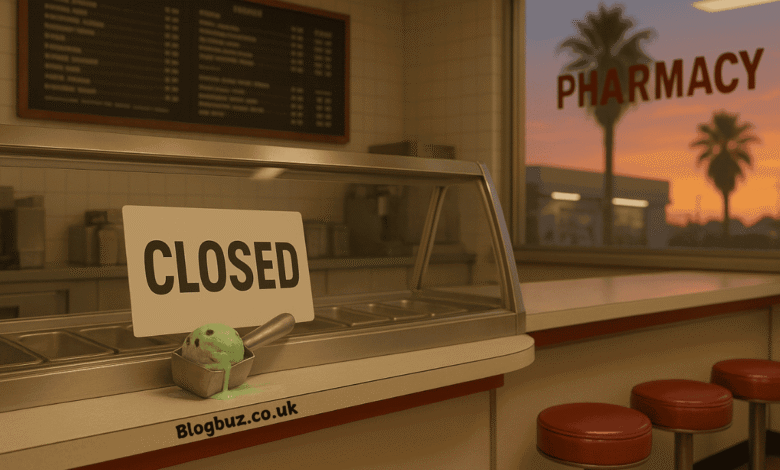

The news that bankruptcy forces ice cream chain to close 500 locations has stirred a mix of nostalgia, frustration, and curiosity among consumers and business watchers. This event centers on the beloved Thrifty Ice Cream, a West Coast favorite sold primarily through Rite Aid pharmacy stores. While the closure of scoop counters signifies the conclusion of an era for numerous devoted supporters, the brand itself is not disappearing. Instead, this story highlights how corporate restructuring can ripple through connected businesses and how iconic brands can reinvent themselves even after a significant setback.

The History of Thrifty Ice Cream

To understand why the news of closures is so impactful, it’s essential to recognize the history of Thrifty Ice Cream. Founded in the early 20th century as part of Thrifty Drug Stores, the brand gained fame for its affordable scoops and its signature square-shaped ice cream scooper. When Rite Aid acquired Thrifty in the late 1990s, the tradition of selling ice cream in pharmacies became a quirky but cherished West Coast experience.

Generations of Californians and residents of neighboring states grew up grabbing a cone while running errands at the drugstore. The nostalgia attached to Thrifty isn’t just about ice cream flavors—it represents family outings, after-school treats, and an accessible luxury for people from all walks of life.

Bankruptcy Forces Ice Cream Chain to Close 500 Locations: What Happened

The headline bankruptcy forces ice cream chain to close 500 locations refers to the fact that Rite Aid, Thrifty’s parent company, filed for Chapter 11 bankruptcy protection and began closing hundreds of underperforming stores. Since Thrifty’s scoop counters were embedded inside these Rite Aid locations, the counters could not operate independently. As a result, nearly 500 Thrifty scoop counters across the United States shut their doors in 2025.

This situation illustrates how corporate bankruptcy can affect not only the parent company but also any beloved subsidiaries that depend on the parent’s retail footprint. In this case, the closures were less about the performance of ice cream sales and more about the collapse of Rite Aid’s broader retail network.

Why the Closure Matters to Consumers

For many customers, the loss of 500 Thrifty scoop counters feels like losing a piece of cultural heritage. People recall memories of double scoops of Chocolate Malted Krunch or Mint Chip for less than a few dollars—a price point nearly unheard of in today’s premium ice cream market.

The closures also matter because they reduce the availability of a unique in-person experience. While packaged Thrifty ice cream is still sold in supermarkets, the scoop counter tradition can’t be replicated by grabbing a tub from a freezer aisle. The nostalgia, interaction, and ritual of ordering ice cream at a pharmacy counter are irreplaceable for many fans.

What Is Closing and What Is Staying

It is essential to clarify that when bankruptcy forces ice cream chain to close 500 locations, not everything disappears.

- Closing: Scoop counters located inside Rite Aid pharmacies are being permanently shut down. These were the places where customers could order single or double scoops in cones and cups.

- Staying: The Thrifty brand itself remains in existence. Manufacturing continues, and Thrifty tubs are still distributed to grocery chains across California, Nevada, and other regions. Some standalone franchise counters and independent stores may also continue operating.

This means fans can still buy Thrifty products, but they will no longer be able to enjoy the scoop-counter experience in many Rite Aid stores.

How Bankruptcy Affects Legacy Brands

The case where bankruptcy forces ice cream chain to close 500 locations highlights a broader issue in retail and food industries: when a parent company goes bankrupt, smaller brands often face collateral damage.

Legacy brands like Thrifty have decades of customer loyalty, yet they may lack independent infrastructure to survive without the parent company’s stores. This makes them vulnerable to closures, even if demand for their products remains strong.

We’ve seen similar dynamics with other retail bankruptcies—iconic brands shutter physical outlets but sometimes reinvent themselves through licensing, acquisitions, or e-commerce channels.

The Acquisition and Future of Thrifty Ice Cream

While the closures are disappointing, there is a silver lining. In August 2025, Thrifty Ice Cream was acquired by Hilrod Holdings for about $19 million. The group, linked to executives from Monster Beverage, has ambitious plans to revive and expand the brand.

Hilrod Holdings has announced that it will preserve the traditional recipes and the iconic square scoop while introducing modernized packaging, new flavors, and broader retail distribution. Expansion plans include moving beyond Rite Aid and increasing availability through supermarkets, specialty shops, and possibly even standalone scoop shops.

This shows how, even after bankruptcy forces ice cream chain to close 500 locations, substantial brand equity can attract new investment and future opportunities.

The Cultural Impact of Losing Scoop Counters

Beyond economics, the closures resonate emotionally with many communities. Thrifty Ice Cream counters symbolized affordability, accessibility, and a sense of nostalgia. Unlike high-end ice cream parlors, Thrifty offered quality at a price almost anyone could afford.

The scoop counter closures may also reflect a broader cultural shift. As traditional drugstore chains decline and digital retail grows, community gathering spots tied to retail experiences are becoming increasingly scarce. In some ways, the end of Thrifty counters marks not just the end of a business model but also the loss of a neighborhood tradition.

Lessons for the Food and Retail Industry

The story of how bankruptcy forces ice cream chain to close 500 locations offers several lessons:

- Brand Equity Matters: Even in bankruptcy, Thrifty’s brand was valuable enough to attract buyers and investors.

- Retail Format Risks: Brands tied exclusively to one retail channel (like pharmacy counters) risk closures if that channel collapses.

- Nostalgia as a Business Asset: Customer memories and cultural attachment can keep a brand alive even when physical locations shut down.

- Opportunity for Reinvention: Bankruptcy often clears the way for innovation, as seen in Hilrod Holdings’ expansion plans for Thrifty.

Conclusion

The headline bankruptcy forces ice cream chain to close 500 locations tells a story of loss but also resilience. While 500 Thrifty Ice Cream counters inside Rite Aid stores have closed due to bankruptcy, the brand itself is not disappearing. Instead, it is entering a new chapter under fresh ownership, with plans for revival and growth.

You May Also Read: Dual Delights of Cake:mo2m1r-uifu= Ice Spice: From Culinary Innovations to Musical Waves