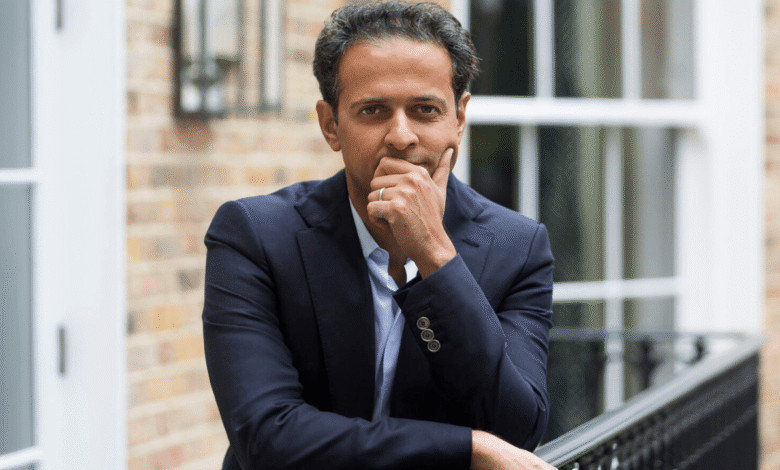

Rishi Khosla: The Visionary Behind OakNorth and the Future of Fintech Banking

Rishi Khosla is a prominent British entrepreneur, investor, and philanthropist best known as the co-founder and CEO of OakNorth Bank, one of the UK’s most successful challenger banks. Over the past decade, Rishi Khosla has transformed how small and medium-sized enterprises (SMEs) access financing by leveraging technology and data analytics to bridge the distance between traditional banking and modern financial innovation. Born in September 1975, Rishi Khosla’s journey from a young economics enthusiast to a globally recognized fintech leader is both inspiring and instructive. His story embodies academic excellence, strategic vision, and an unwavering commitment to helping growing businesses reach their full potential.

Early Life and Education of Rishi Khosla

Rishi Khosla was born in London, United Kingdom, to an Indian family that valued education and entrepreneurship. His father, an engineer, moved the family to Delhi for a few years before returning to London, where Rishi completed his schooling.

From an early age, Rishi Khosla displayed exceptional intelligence and curiosity. Remarkably, he began preparing for his GCSEs at just 11 and completed his A-levels by 13, demonstrating a precocious academic ability rarely seen at such a young age.

He went on to pursue a Bachelor’s degree in Economics from University College London (UCL), one of the UK’s top universities. Later, he obtained a Master’s degree in Accounting and Finance from the London School of Economics (LSE), solidifying his academic foundation in finance and economics.

This strong educational background later became instrumental in shaping his understanding of global markets, risk assessment, and financial innovation — skills that would define his career.

Rishi Khosla’s Early Career

After completing his studies, Rishi Khosla began his professional journey in 1995 with ABN AMRO, a Dutch bank known for its strong international presence. His time there gave him hands-on experience in banking operations and credit assessment, building the foundation for his future ventures.

By 1999, he had joined GE Capital, the financial services arm of General Electric. There, Khosla gained deep insights into large-scale lending, investment, and portfolio management. He also worked closely with high-net-worth clients and institutional investors, expanding his understanding of global finance.

A turning point came when he managed a private equity portfolio for steel magnate Lakshmi Mittal, one of the world’s wealthiest industrialists. In this role, Rishi Khosla was exposed to the world of venture capital and early-stage investing. He helped fund promising technology firms, including early fintech innovators such as PayPal, long before fintech became a mainstream buzzword.

The Birth of Copal Partners

In 2002, Rishi Khosla co-founded Copal Partners with his long-time friend and business partner Joel Perlman. Copal Partners was a financial research and analytics company that provided outsourced services to investment banks, private equity firms, and asset managers.

At the time, outsourcing high-end financial analytics was a novel concept. However, Khosla’s vision was clear: to combine financial expertise with cost-efficient delivery from emerging markets. The company quickly grew, establishing offices across India, the UK, and the United States.

Under Khosla’s leadership, Copal Partners became one of the most respected financial analytics firms in the world. It specialized in research support, valuation, due diligence, and portfolio analytics for major global institutions. The company’s innovative model helped clients cut costs while improving the quality of their insights.

In 2014, Copal Partners (by then known as Copal Amba) was acquired by Moody’s Corporation, a leading global credit rating agency. This successful exit marked a significant milestone in Khosla’s career, proving his ability to build and scale global financial enterprises.

Founding OakNorth: The Challenger Bank Revolution

Following the success of Copal Amba, Rishi Khosla and Joel Perlman turned their attention to a new challenge: addressing the financing gap faced by small and medium-sized businesses.

In 2015, they founded OakNorth Bank, a digital-first bank focused on providing customized loans to growth-oriented companies. While traditional banks often relied on rigid credit models, OakNorth used advanced data analytics, machine learning, and sector-specific intelligence to assess creditworthiness more accurately.

That same year, OakNorth received its full UK banking license from the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA). It was one of the few new banking licenses granted in decades, marking the start of a major fintech success story.

OakNorth’s mission was clear — to empower the “missing middle”: businesses that are too large for microfinance but too small to attract traditional corporate lending. Through its innovative technology platform, OakNorth provided quick, flexible, and transparent loans, helping thousands of companies grow.

Rishi Khosla’s Leadership and OakNorth’s Success

Under Rishi Khosla’s leadership, OakNorth Bank has grown exponentially. By 2024, the bank had provided over £10 billion in business loans, supporting sectors like real estate, technology, manufacturing, and hospitality.

Khosla introduced ON Credit Intelligence (ONCI), OakNorth’s software division, which licenses the bank’s proprietary credit analysis platform to other financial institutions worldwide. This arm of the business has become a key growth driver, allowing OakNorth to scale beyond the UK market.

OakNorth’s approach to data-driven lending is now seen as one of the most successful fintech innovations of the 21st century. Unlike traditional banks, which often rely on outdated credit models, OakNorth uses real-time data and predictive analytics to evaluate business potential rather than relying solely on historical performance.

Awards and Recognition for Rishi Khosla

Rishi Khosla’s contributions to entrepreneurship and fintech have earned him numerous awards and accolades. Some of his most notable recognitions include:

- Ernst & Young Entrepreneur of the Year Award (2011) for his success with Copal Amba.

- Officer of the Order of the British Empire (OBE), awarded in 2020 for his services to business.

- Named among Europe’s Top Fintech Entrepreneurs by leading publications such as Forbes, Financial Times, and Sifted.

- Regular speaker and contributor at the World Economic Forum, sharing insights on entrepreneurship, innovation, and the future of banking.

Khosla’s leadership style — disciplined, data-driven, and forward-looking — has made him a respected figure in both traditional finance and the tech world.

Rishi Khosla Net Worth and Financial Influence

While exact figures vary, Rishi Khosla’s net worth is estimated at hundreds of millions of pounds. His wealth primarily comes from his equity stakes in OakNorth and previous business exits.

Reports suggest his share in OakNorth alone could be worth over £650 million, depending on market valuations. Beyond financial success, Khosla is admired for his commitment to ethical business practices, innovation, and mentorship of new entrepreneurs.

Philanthropy and the Rishi & Milan Khosla Foundation

Beyond business, Rishi Khosla is deeply committed to philanthropy. Along with his wife Milan Khosla, he co-founded the Rishi & Milan Khosla Foundation, which supports initiatives in:

- Early childhood development

- Women’s empowerment

- Environmental sustainability

- Medical research and healthcare

The foundation actively supports charities in the UK, India, and developing countries, focusing on long-term impact rather than short-term aid.

Through this foundation, Khosla demonstrates his belief that success is meaningful only when it contributes to others’ well-being.

Rishi Khosla’s Vision for the Future

Rishi Khosla envisions a world where technology, data, and human insight combine to create a more inclusive and efficient financial ecosystem. His focus remains on scaling OakNorth globally and enabling more banks to use its credit intelligence technology.

In interviews, Khosla often highlights the importance of supporting entrepreneurs and SMEs, which he sees as the backbone of economic growth. He believes that traditional banks have failed this segment for too long, and fintech innovation can change that.

As OakNorth continues to expand into markets like the United States and Asia, Khosla’s leadership will likely play a crucial role in shaping the next generation of innovative banking solutions.

Personal Life of Rishi Khosla

Rishi Khosla lives in London with his wife, Milan, and their four children. Despite his enormous success, he is known for his humility and discipline. He avoids excessive publicity and instead focuses on building sustainable ventures that create long-term value.

Outside work, he is passionate about reading, fitness, and mentoring young entrepreneurs. His social media presence — particularly on Instagram (@rishikhosla) — reflects his interest in business innovation, family, and travel.

Conclusion: The Legacy of Rishi Khosla

Rishi Khosla’s story is a remarkable example of how vision, perseverance, and innovation can transform industries. From his early beginnings in finance to founding one of the UK’s most successful challenger banks, Rishi Khosla embodies the modern entrepreneurial spirit.

You May Also Read: Jonathan Bloomer Net Worth: A Detailed Look at the Former Morgan Stanley Chairman’s Fortune