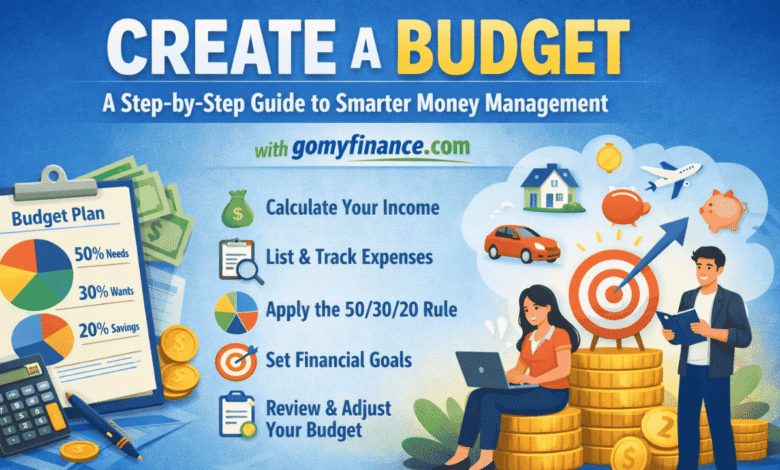

Gomyfinance.com create budget: A Complete Step-by-Step Guide to Smarter Money Management

Creating a budget is one of the most powerful measures you can take toward financial stability and long-term success. Yet, for many people, budgeting feels overwhelming, confusing, or restrictive. That’s where gomyfinance.com create budget comes in—a practical and beginner-friendly approach to building a budget that actually works in real life. This guide will walk you through everything you need to know about creating a budget using the gomyfinance.com create budget approach, from understanding your income to tracking expenses, setting goals, and adjusting your plan as life changes. Whether you are new to budgeting or trying to fix a broken system, this article will help you build a sustainable financial plan with confidence.

What does gomyfinance.com create budget Mean?

The gomyfinance.com create budget refers to a structured, simplified budgeting method based on GoMyFinance-style budgeting principles. Rather than focusing on rigid spreadsheets or extreme spending cuts, this approach emphasizes clarity, flexibility, and long-term consistency.

At its core, the gomyfinance.com create budget method helps you:

- Understand where your money comes from

- Track where it goes

- Allocate funds intentionally

- Prepare for emergencies

- Work toward financial goals without stress

This method is especially popular among beginners because it breaks budgeting into manageable steps and avoids complicated financial jargon.

Why Budgeting Is Essential for Financial Stability

Before diving into how to use gomyfinance.com create budget, it’s important to understand why budgeting matters in the first place.

A budget allows you to:

- Avoid living paycheck to paycheck

- Reduce unnecessary spending

- Build savings and emergency funds

- Pay down debt faster

- Feel more confident and in control of your finances

Without a budget, money tends to disappear without explanation. With a clear plan, every dollar has a purpose, and financial decisions become intentional instead of emotional.

Calculate Your Total Monthly Income

The first step in the gomyfinance.com create budget process is knowing exactly how much money you earn each month.

Start by listing all income sources, such as:

- Salary or hourly wages (after taxes)

- Freelance or side income

- Business revenue

- Government benefits or support

- Passive income streams

Use your average monthly income if your earnings fluctuate. Accuracy here is crucial because your entire budget is built on this number

List and Categorize Your Expenses

Once your income is clear, the next step is to identify where your money is going. The gomyfinance.com create budget approach divides expenses into two main categories: fixed and variable.

Fixed Expenses

These are recurring and predictable costs, such as:

- Rent or mortgage

- Utilities

- Insurance

- Loan payments

- Subscriptions

Variable Expenses

These change from month to month and often provide opportunities to save:

- Groceries

- Dining out

- Transportation

- Entertainment

- Personal spending

Tracking expenses for at least 1 to 3 months gives you a realistic picture of your spending habits.

Apply a Budgeting Framework (50/30/20 Rule)

One of the most popular frameworks used with gomyfinance.com create budget is the 50/30/20 rule.

Here’s how it works:

- 50% for needs: Housing, utilities, food, transportation

- 30% for wants: Entertainment, hobbies, dining out

- 20% for savings and debt repayment

This structure provides balance. It ensures your essentials are covered while still allowing enjoyment and future planning. You can adjust the percentages to suit your personal situation, especially if you are aggressively paying off debt or building savings.

Set Clear Financial Goals

Budgeting without goals often leads to frustration. The gomyfinance.com create budget system that emphasizes goal-based budgeting to keep you motivated.

Examples of financial goals include:

- Building an emergency fund

- Paying off credit card debt

- Saving for a vacation

- Buying a home

- Investing for retirement

Break big goals into smaller monthly targets. This makes progress measurable and keeps you focused.

Create Spending Limits for Each Category

Once you understand your income, expenses, and goals, it’s time to set spending limits.

With the gomyfinance.com create budget approach:

- Assign a maximum amount to each category

- Prioritize essential expenses first

- Reduce overspending areas gradually

- Leave room for flexibility

The goal is not perfection but consistency. A budget that allows minor adjustments is more likely to succeed in the long term.

Track Your Spending Regularly

A budget only works if you track your spending. This step is where many people fail, but it’s also where real transformation happens.

You can track spending by:

- Using budgeting apps

- Reviewing bank statements weekly

- Maintaining a simple spreadsheet

- Writing expenses in a notebook

The gomyfinance.com create budget philosophy encourages frequent check-ins, not obsessive monitoring. A weekly review is often enough to stay on track.

Adjust Your Budget as Life Changes

Life is unpredictable, and your budget should reflect that. One of the strengths of the gomyfinance.com create budget method is its adaptability.

You may need to adjust your budget when:

- Your income changes

- Expenses increase or decrease

- You experience a financial emergency

- Your priorities shift

Instead of abandoning your budget, treat adjustments as part of the process. A flexible budget is a sustainable budget.

Common Budgeting Mistakes to Avoid

Even with a strong system like gomyfinance.com create budget, mistakes can happen. Be aware of these common pitfalls:

- Setting unrealistic limits

- Forgetting irregular expenses

- Ignoring small daily purchases

- Not reviewing the budget regularly

- Giving up after one bad month

Budgeting is a skill that improves over time. Mistakes are learning opportunities, not failures.

Benefits of Using the gomyfinance.com Create Budget Approach

By following this method consistently, you can experience long-term benefits such as:

- Better money awareness

- Reduced financial stress

- Improved saving habits

- Faster debt repayment

- Increased confidence in financial decisions

The gomyfinance.co create budget approach is not about restriction—it’s about empowerment.

Conclusion: Take Control of Your Finances Today

Learning how to manage money effectively is one of the most valuable life skills, and the gomyfinance.com create budget method offers a clear and achievable path to financial success. By understanding your income, tracking expenses, setting goals, and regularly reviewing your plan, you can create a budget that supports your lifestyle rather than limits it.

You May Also Read: GoMyFinance.com Credit Score: Credit Management and Financial Wellness