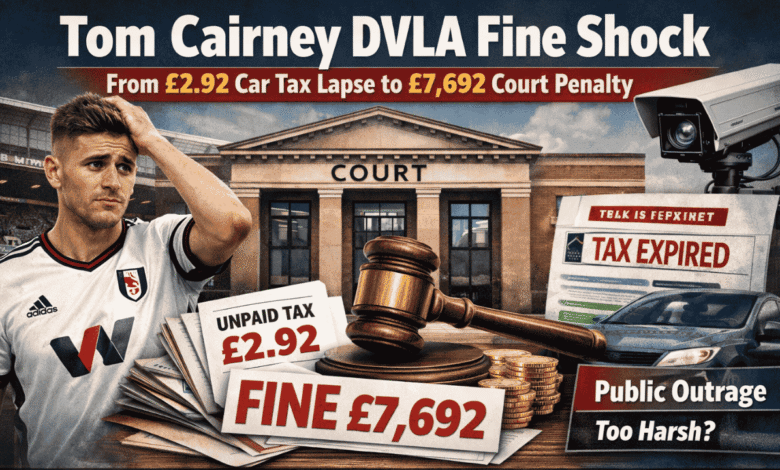

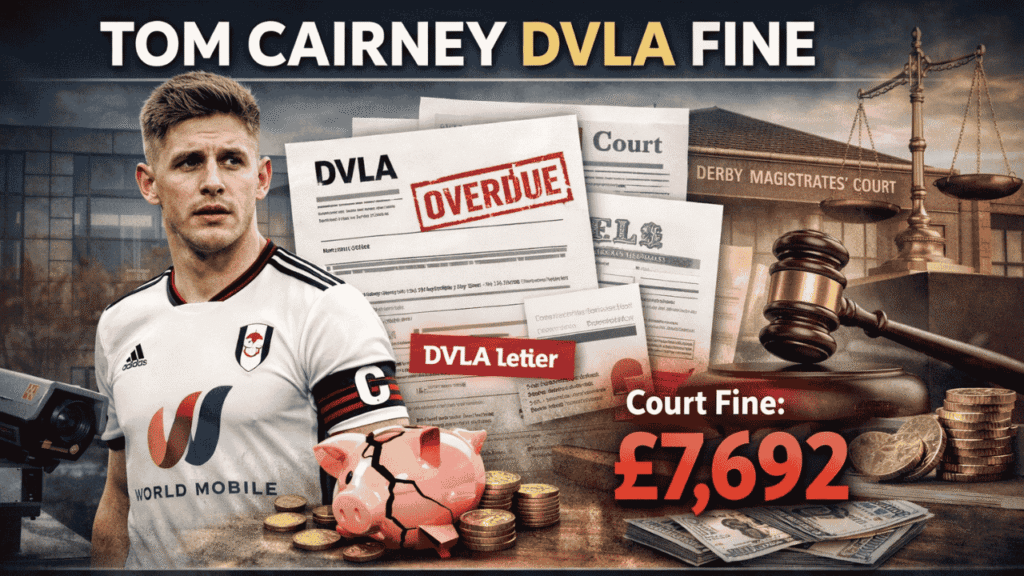

Tom Cairney DVLA Fine: How a £2.92 Car Tax Oversight Turned into a £7,692 Court Penalty

The Tom Cairney DVLA fine surged across search engines and sports news after reports emerged that Fulham captain Tom Cairney had been fined thousands of pounds over an unpaid car tax bill worth less than the price of a cup of coffee. The story quickly went viral, not only because Cairney is a well-known Premier League footballer, but because the figures involved seemed wildly disproportionate: a £2.92 tax shortfall leading to a fine of £7,692. For many motorists, the case raised uncomfortable questions. How can such a small administrative mistake lead to such a large penalty? Is this how the DVLA normally enforces vehicle tax rules? And what does this mean for everyday drivers who might miss a renewal date? This article explores the full context of the Tom Cairney DVLA fine, how the system works, why the penalty became so large, and what drivers can learn from the case.

Who Is Tom Cairney?

Tom Cairney is a Scottish professional footballer and long-time captain of Fulham Football Club. Known for his leadership in midfield and calm presence on the pitch, Cairney has played a major role in Fulham’s promotion campaigns and their stability in the Premier League.

With a career spent largely out of controversy, the sudden appearance of his name in court reporting took many fans by surprise. This was not a case involving reckless driving or criminal intent, but rather an administrative oversight involving vehicle tax – something millions of UK drivers deal with every year.

What Actually Happened in the Tom Cairney DVLA Fine Case?

According to court reporting, the issue began when Cairney’s vehicle tax (Vehicle Excise Duty) expired in September 2024. The unpaid amount for the period in question was just £2.92, covering slightly over a month during which the vehicle was technically unlicensed.

The Driver and Vehicle Licensing Agency (DVLA) detected the untaxed status in late October. As with many similar cases, enforcement action followed. The matter was processed through the Single Justice Procedure (SJP), a system designed to handle minor offences without requiring a full court hearing.

Under this procedure, a magistrate may decide a case based on written evidence if the defendant does not respond or attend. Ultimately, Derby Magistrates’ Court imposed a fine totaling £7,692, including penalties and associated costs.

Cairney later stated that he had simply forgotten to renew the tax and accepted responsibility for the oversight.

Why Was the Fine So High?

This is the part that shocked the public most. How does £2.92 become nearly £8,000?

Several factors help explain it:

Court-Based Penalties Can Escalate

When vehicle tax offences are handled in court rather than through fixed penalties, fines can be linked to income levels. For high earners, including professional athletes, magistrates may apply income-based calculations to ensure penalties remain a deterrent.

The Single Justice Procedure

The SJP is designed to be efficient, but it can also mean that cases proceed quickly if paperwork is missed or responses are delayed. If the defendant does not contest the charge or provide mitigation early, the magistrate may rely solely on the information provided.

Additional Costs and Surcharges

Court fines often include:

- A base fine

- Prosecution costs

- A victim surcharge

Together, these can significantly multiply the total amount.

Public Example Effect

While courts deny targeting individuals, high-profile cases often attract attention because they highlight how the system operates when applied to high earners.

How the DVLA Enforces Vehicle Tax Rules

To understand the Tom Cairney DVLA fine, it helps to understand how enforcement normally works.

Automatic Number Plate Recognition (ANPR)

The DVLA uses ANPR cameras and database checks to identify untaxed vehicles on public roads.

Fixed Penalty Notices

Most drivers first receive:

- A Late Licensing Penalty (LLP)

- Or a fixed fine (usually much smaller, often £80–£100)

Escalation to Court

If the fine is unpaid, disputed incorrectly, or processed under certain conditions, the case may be referred to the magistrates’ court.

At that point, penalties can increase substantially, especially if income-based calculations are applied.

Is This Normal for Everyday Drivers?

In practice, most drivers will never face anything close to a £7,692 fine for missing car tax.

For typical motorists:

- Late renewal often leads to reminder letters.

- Fixed penalties are relatively small.

- Court action is usually a last resort.

However, the Cairney case demonstrates that:

- The legal maximum penalties exist.

- Courts have discretion.

- High income can dramatically increase the fine.

This does not mean the system is “broken,” but it does show that enforcement can look extreme when applied to wealthy individuals.

Public Reaction to the Tom Cairney DVLA Fine

The story triggered widespread debate online:

Sympathy for Cairney

Many fans and commentators felt the punishment was excessive, given the tiny amount owed.

Anger at the System

Some argued that the DVLA and courts are overly punitive for administrative mistakes.

Others Defended the Rules

A smaller group pointed out that:

- Car tax is a legal requirement.

- The rules apply to everyone.

- High earners should not receive lighter treatment.

The divide highlights ongoing tension between fairness, deterrence, and proportionality in the justice system.

Could the Case Be Reopened or Reduced?

Reports indicated that applications were being made to review or reopen the case. UK courts can revisit decisions in certain circumstances, particularly if:

- Paperwork was not received.

- The defendant was unaware of the proceedings.

- There was a procedural error.

Whether Cairney’s fine will ultimately be reduced remains a legal matter, but the publicity alone has already sparked calls for reform of how minor motoring offences are handled.

Lessons for UK Drivers

Regardless of fame or income, the case offers several practical lessons:

Always Set Up DVLA Reminders

The DVLA offers free email and text reminders. Use them.

Check Auto-Renewal

Car tax no longer renews automatically unless you set up a direct debit.

Open Official Letters

DVLA and court letters should never be ignored, even if you believe a mistake has been made.

Respond Quickly to Legal Notices

Under the Single Justice Procedure, silence can lead to a conviction and fine without your presence.

Keep Records

Payment confirmations and renewal emails can be crucial in the event of a dispute.

What This Case Says About the UK Justice System

The Tom Cairney DVLA fine case is not just about car tax; it highlights broader issues:

- The balance between automation and human judgment

- Whether income-based fines are fair or excessive

- The transparency of the Single Justice Procedure

- Public understanding of how minor offences are prosecuted

For some, the system worked exactly as designed. For others, it revealed a process that can feel unforgiving and disconnected from common sense.

Conclusion

The story behind the Tom Cairney DVLA fine is a modern cautionary tale: in an automated legal system, even a small oversight can spiral into a major financial penalty, especially when courts apply income-based calculations.