Startup Booted Fundraising Strategy: A Practical Guide for Founders Who Want Traction Before Capital

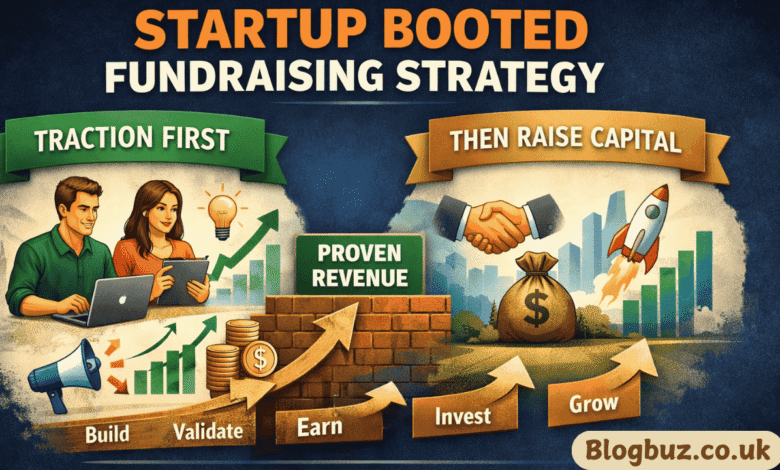

A startup booted fundraising strategy is a disciplined approach where founders build momentum with their own resources and early revenue first, and only pursue outside capital when it becomes a strategic accelerator—not a lifeline. Many founders assume fundraising is the first milestone. In reality, the strongest startups often earn the right to fundraise by demonstrating traction, learning cheaply, and proving demand before stepping into investor conversations. This guide explains how to do exactly that: how to operate lean, validate fast, and then raise capital from a position of strength.

What Startup Booted Really Means

Startup boot is commonly used as a synonym for bootstrapped—starting and growing a company with:

- Founder savings

- Early customer revenue

- Ruthless cost control

- Careful prioritization

- Minimal dilution

This doesn’t mean raising money. It means delaying fundraising until your startup has evidence: users, revenue, retention, or clear growth signals. At that point, capital becomes a growth multiplier rather than a survival requirement.

Why This Strategy Is Becoming Popular With Modern Founders

Several shifts in the startup ecosystem make a startup booted fundraising strategy especially powerful today:

- Cloud tools and AI reduce startup costs

- Distribution is cheaper through social, content, and communities

- Revenue-based financing and non-dilutive options exist

- Investors prefer traction over ideas

- Founders want to preserve ownership and control

Because it’s cheaper than ever to test an idea, there’s less need to raise prematurel

Build With Constraints (The Booted Stage)

In this phase, the goal is not growth. The goal is proof.

You focus on:

- Building a scrappy MVP

- Talking to users daily

- Charging early (even small amounts)

- Keeping burn extremely low

- Learning faster than you spend

Key rule: If money can solve the problem, you’re asking the wrong question. The real question is how to solve it without spending money.

This phase teaches clarity:

- Who your real customer is

- What they actually pay for

- What features don’t matter

- What messaging converts

Revenue Before Fundraising

A core pillar of a startup booted fundraising strategy is getting paying customers before investors.

Even 10–50 paying users change everything:

| Pitch is hypothetical | Pitch is evidence-based |

| Investors ask “will it work?” | Investors ask “how big can it get?” |

| Valuation is lower | Valuation is higher |

| You need investors | Investors want you |

Revenue proves demand. And demand is what investors truly fund.

Use Non-Dilutive Capital First

Before selling equity, founders using this strategy explore options like:

- Pre-sales and annual plans

- Consulting or services tied to the product

- Revenue-based financing

- Grants or startup credits

- Strategic partnerships

These methods extend the runway without giving up ownership.

This is the quiet advantage of the startup booted approach: time. More runway means better decisions.

Fundraise From a Position of Strength

Now fundraising becomes strategic.

You raise when you have:

- Clear user growth

- Revenue or strong engagement

- Product-market fit signals

- Repeatable acquisition

- Strong retention

At this point, capital is used to:

- Hire faster

- Scale marketing

- Expand product

- Enter new markets

This mirrors advice from Y Combinator, which emphasizes traction and clarity before seed rounds, and essays by Paul Graham on fundraising as a tradeoff best taken when speed truly matters.

How This Differs From the Traditional VC-First Path

| Raise on idea | Raise on proof |

| Hire early | Hire after validation |

| Spend to find PMF | Find PMF cheaply |

| High dilution early | Lower dilution later |

| Pressure to grow fast | Freedom to learn first |

This approach reduces existential risk and increases founder leverage.

Metrics That Matter Before You Raise

Investors respond strongly when you can show:

- Monthly revenue growth

- Customer retention

- Organic referrals

- Low churn

- Clear customer persona

- CAC < LTV (even if small scale)

You don’t need huge numbers. You need credible patterns.

Common Mistakes Founders Make

- Raising too early because “that’s what startups do”

- Hiring before validating

- Building features instead of talking to users

- Confusing hype with demand

- Assuming funding equals success

A startup booted fundraising strategy avoids these traps by forcing evidence first.

When You Should NOT Use This Strategy

This strategy is not ideal if:

- You’re building deep tech that requires heavy R&D

- You need regulatory approval before revenue

- Speed to market is critical due to competition

- Hardware or biotech capital requirements are unavoidable

In these cases, raising early can be necessary.

Real-World Pattern You’ll Notice

Many successful startups follow this hidden timeline:

- Quiet bootstrapping

- Early paying customers

- Small team, tight burn

- Traction appears

- Then a “sudden” seed round announcement

From the outside, it looks fast. Internally, it was a careful startup with a fundraising strategy.

How to Start Applying This Today

- Cut unnecessary tools and expenses

- Talk to 5 users per day

- Charge for something this week

- Track retention, not vanity metrics

- Delay fundraising conversations

- Focus on proving demand

The goal is simple: make your startup investor-ready before meeting investors.

The Psychological Advantage for Founders

Booted founders are calmer in fundraising because:

- They don’t need the money

- They know their customer deeply

- They have evidence, not hope

- They can walk away from bad terms

That confidence often results in better deals.

Conclusion: Why the Startup Booted Fundraising Strategy Works

A startup booted fundraising strategy flips the usual startup script. Instead of chasing capital to find product-market fit, you find product-market fit to attract capital.

You start with constraints, earn revenue early, learn cheaply, and only then bring in outside funding as a growth engine. This preserves ownership, improves valuation, and dramatically increases the odds of building something real.

You May Also Read: FintechAsia .net Start Me Up: Empowering the Next Wave of Fintech Innovation