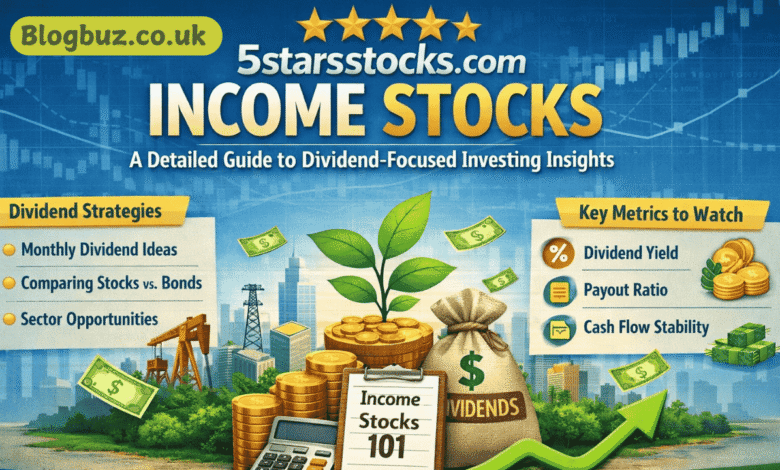

5starsstocks.com Income Stocks: A Detailed Guide to Dividend-Focused Investing Insights

Income investing has become increasingly popular among investors who want consistent cash flow, reduced volatility, and long-term portfolio stability. As more people search for reliable information on dividend strategies, a specific phrase has begun appearing in search trends: 5starsstocks.com income stocks. This keyword reflects growing curiosity about how the website approaches dividend-paying stocks, the guidance it offers, and whether its content can help investors better understand income-focused investing. In this article, we’ll take a deep look at what 5starsstocks.com’s income stocks content actually represents, how the site structures its dividend and income investing material, the types of topics covered, and how readers can use this information responsibly as part of their own research process.

Understanding What Income Stocks Mean

Before exploring the website itself, it’s important to understand what income stocks are in general investing terms.

Income stocks are units of companies that generate consistent revenue and dividends to shareholders. These companies are usually:

- Established, mature businesses

- Operating in stable industries

- Generating consistent cash flow

- Focused on rewarding shareholders through dividends rather than aggressive expansion

Common sectors for income stocks include:

- Utilities

- Real estate investment trusts (REITs)

- Financial services

- Consumer staples

- Telecommunications

- Energy infrastructure

These stocks are popular among retirees, conservative investors, and those seeking predictable returns without relying solely on price appreciation.

What Is 5StarsStocks.com?

5StarsStocks.com presents itself as a stock research and analysis platform that organizes content by investment style, sector, and theme. One of its key content categories falls under:

Investment Style → Dividend Stocks → Income Stocks

This is where the focus keyword 5starsstocks.com income stocks originates. The site hosts a dedicated archive page that collects articles related to dividend investing, cash-flow strategies, and income-oriented stock ideas.

The content is blog-style, educational, and regularly updated with new posts discussing different angles of income investing.

The Structure of the 5starsstocks.com Income Stocks Section

The income stocks category is not a single article but a living archive of posts that discuss dividend investing from multiple perspectives.

Typical themes found in this section include:

- Monthly dividend stock ideas

- Comparisons between preferred stocks and bonds

- Sector-based dividend opportunities (e.g., fintech, manufacturing, REITs)

- Warning signs of dividend cuts

- Emerging industries for income investors

- Portfolio balancing for cash flow

This variety of topics indicates that the 5starsstocks.com income stocks section aims to educate readers on how income investing works rather than simply listing stock tickers.

Types of Articles You’ll Find in the Income Stocks Archive

When reviewing the category, you’ll notice several recurring article types:

Educational Foundations

These posts explain what income stocks are, how dividends work, and how investors should evaluate dividend sustainability.

Comparative Pieces

Examples include:

- Preferred stocks vs. bonds

- Dividend stocks vs. growth stocks

- REITs vs. traditional equities for income

These articles help readers understand trade-offs between different income strategies.

Thematic Opportunities

Some posts explore new or emerging industries from a dividend perspective, such as fintech companies or manufacturing themes that may offer income potential.

Practical Cash-Flow Ideas

Articles such as “monthly dividend stocks” focus on smoothing income streams throughout the year — a concept that appeals strongly to retirees and passive-income seekers.

Why People Search for 5starsstocks.com Income Stocks

Search intent around this keyword typically falls into two categories:

Informational Intent

People want to know:

- What kind of income does the site provide for stock advice?

- Whether the content is beginner-friendly

- What topics are covered

Verification / Trust Intent

Searchers also want to evaluate:

- Whether the site is legitimate

- Whether the advice is credible

- Whether it is worth reading or following

This means the keyword often attracts readers who are cautious and do due diligence before trusting any investment resource.

How the Site Explains Income Investing

One of the foundational pieces associated with the 5starsstocks.com income stocks theme is a beginner-style explainer often referred to as “Income Stocks 101.” This article lays out:

- The definition of income stocks

- Key sectors to watch

- Metrics investors should understand (dividend yield, payout ratio, etc.)

- The importance of dividend sustainability over high yield

This approach suggests the site aims to be educational rather than promotional.

Common Metrics Discussed in the Articles

Throughout the income stocks content, several important investing metrics are frequently referenced:

- Dividend Yield – The annual dividend relative to the share price

- Payout Ratio – How much of earnings are used to pay dividends

- Cash Flow Stability – Whether the company can maintain payments

- Debt Levels – High debt can threaten dividends

- Dividend History – Companies with long records of consistent payments

These are standard evaluation tools used by professional dividend investors, indicating the site follows conventional investing analysis methods.

The Emphasis on Risk Awareness

A notable feature of the website is its consistent disclaimer that the content is not financial advice. This is important because dividend investing can carry risks, such as:

- Dividend cuts during economic downturns

- Companies offering unsustainably high yields

- Sector-specific risks (e.g., real estate, energy, financials)

The content frequently encourages readers to perform their own research or consult a financial advisor.

Who the Content Is Likely Written For

The tone and subject matter of the 5starsstocks.com income stocks articles suggest the intended audience includes:

- Beginner dividend investors

- Retirees seeking passive income

- Long-term conservative investors

- Readers learning about portfolio cash-flow strategies

The articles are written in accessible language rather than technical finance jargon, making them suitable for non-professionals.

Topics That Appear Frequently in the Archive

Based on the range of posts, these themes appear regularly:

- Monthly dividend strategies

- Comparing income instruments (stocks, bonds, preferred shares)

- Dividend sustainability analysis

- Sector-specific income opportunities

- Defensive investing during uncertain markets

This shows the category is designed as an evolving resource rather than a static list of stock picks.

How to Use Information from 5starsstocks.com Income Stocks Responsibly

If you’re reading this section for ideas, the best approach is to:

- Use it as a learning tool for dividend concepts.

- Treat stock mentions as starting points for deeper research.

- Cross-reference ideas with financial reports and trusted data sources.

- Avoid making decisions based solely on a single article.

This turns the site into a helpful educational supplement rather than a primary source for decision-making.

Why Dividend and Income Investing Remain Popular

The popularity of keywords like 5starsstocks.com income stocks reflects a broader investing trend:

- Market volatility pushes investors toward stable returns

- Rising interest in passive income

- Retirement planning needs

- Desire for predictable cash flow

Dividend strategies appeal to people who prefer reliability over high-risk, speculative growth.

The Difference Between High Yield and Safe Yield

A key concept often emphasized in income investing (and echoed in the site’s content) is:

The highest dividend yield is not always the safest.

Companies offering extremely high yields may be struggling financially. Sustainable dividends usually come from companies with:

- Strong earnings

- Healthy balance sheets

- Long dividend histories

This principle is critical for new investors to understand.

How the Archive Format Helps Readers

Because the income stocks section is an archive, readers can:

- Browse by topic

- See evolving ideas over time

- Learn from multiple angles of dividend investing

- Build knowledge gradually

This makes the content more like a mini-library of dividend education.

Conclusion

The 5starsstocks.com income stocks represent more than a single article or stock list. It points to a dedicated section of a stock research website that educates readers on dividend- and income-oriented investing strategies.

You May Also Read: 5StarsStocks.com Lithium: A Complete Guide to Lithium Investing, Market Trends & Top Stocks