Turn You Cash CycleMoneyCo Around: A Practical Guide to Fixing Your Cash Flow Fast

Turn You Cash CycleMoneyCo Around, you’re probably dealing with one of the most frustrating financial problems: money comes in, but it doesn’t stay in. You may be earning well, making sales, or even running a growing business—yet you still feel stuck in a constant cycle of “pay bills → wait for income → repeat.” The good news is that cash flow problems are fixable. And in many cases, you don’t need a miracle. You need a system. This guide breaks down what people usually mean when they say turn your cash CycleMoneyCo around, why cash gets trapped in the wrong places, and the practical steps you can take to regain control of your money—whether you’re managing personal finances or running a small business.

What Does Turn You Cash CycleMoneyCo Around Actually Mean?

The turn you cash cyclemoneyco around has been popping up in online discussions about cash flow and money management. While the wording may sound unusual, the meaning behind it is clear:

It’s about changing your money cycle so cash moves in your favor instead of against you.

In other words, it’s the process of:

- getting paid faster

- spending more intentionally

- Reducing financial leaks

- building a buffer

- and creating a repeatable system for cash stability

Some people interpret CycleMoneyCo as a budgeting framework. Others treat it like a cash-flow method. Either way, the core concept is the same:

If you can control your cash cycle, you can control your life and your business.

Why Your Cash Cycle Feels Broken (Even When You’re “Doing Fine”)

One of the most confusing parts of money problems is that you can feel broke even while making a decent income.

This usually happens for 5 reasons:

Your cash is arriving late

If your income comes in irregularly (freelancing, commission, delayed invoices), your cash flow can feel unstable even if your annual income is high.

Your bills come first

Most people’s cash cycle is backwards: expenses happen automatically, while income is uncertain.

Your money has no “job”

When money hits your account without a plan, it disappears into random spending, subscriptions, food delivery, and small purchases that add up.

You’re mixing personal and business cash

This is a big one for entrepreneurs. If personal spending comes out of business income without structure, your cash cycle becomes chaotic.

You don’t have a buffer

Without a cash buffer, every small surprise becomes a financial crisis.

To turn you cash CycleMoneyCo around, you need to reverse the pattern: make income predictable, make expenses controlled, and create a cash cushion.

The CycleMoneyCo Approach: Think in “Cycles,” Not Just Budgets

Most people try to fix money problems by creating a budget. But budgets often fail because they don’t match real life.

A better approach is to think in cycles.

A cash cycle is simply:

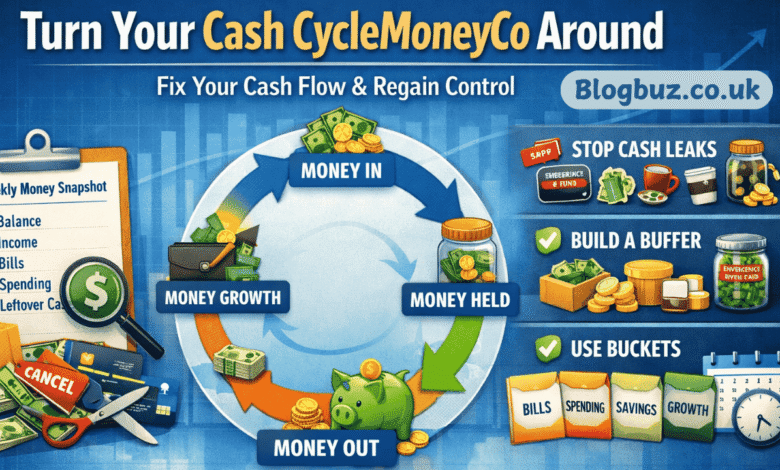

Money in → money held → money used → money replenished

If you can improve even one part of that cycle, your finances get easier fast.

The CycleMoneyCo concept (as people use it online) focuses on:

- How money flows

- where money gets stuck

- and how to keep it circulating strategically

This is especially useful if you’re:

- living paycheck to paycheck

- dealing with inconsistent income

- managing debt

- running a business with slow customer payments

Track Your Real Cash Flow (Not Just Your Income)

To turn your cash cycle around, you first need to stop guessing.

A lot of people track income monthly, but ignore timing.

Instead, track cash flow weekly.

What to track weekly:

- money received

- money spent

- money owed

- money due

- account balance trend

A simple way to do this is with a “Weekly Money Snapshot.”

Every week, write down:

- current balance

- expected income this week

- Fixed bills this week

- flexible spending estimate

- minimum debt payments

- leftover cash

This gives you a real-time view of your cash cycle and stops the “surprise broke” problem.

Fix the #1 Cash Leak: Subscription & Auto-Spend

If you want to turn your cash CycleMoneyCo around quickly, start with the easiest wins.

Most people leak cash in places they don’t even notice:

- streaming services

- unused apps

- random memberships

- delivery fees

- daily small purchases

Here’s the trick:

It’s not about cutting everything. It’s about stopping the invisible spending.

Quick action plan:

- Cancel 2 subscriptions today

- Remove stored card details from shopping apps

- Add a 24-hour rule for online purchases

- Replace impulse spending with a “fun budget” line item

When you control leaks, cash stays longer—your cycle improves instantly.

Build a Mini Buffer (Even If You’re Broke)

A lot of people believe they need to pay off debt first, then save.

But cash flow stability requires a buffer.

Even a small buffer can dramatically change your financial cycle.

Start with:

- $100 emergency buffer

- then $500

- Then 1 month of essential expenses

This is the foundation of turning your cash cycle around.

Why?

Because when unexpected expenses happen (car repairs, medical bills, late fees), you stop falling into debt or overdrafts.

Create a Cash Cycle System With Separate Buckets

A powerful CycleMoneyCo-style method is separating money into buckets.

Not physically (although you can), but by purpose.

The 4-bucket structure:

- Bills Bucket (rent, utilities, debt minimums)

- Daily Spending Bucket (food, fuel, personal)

- Savings Bucket (buffer + goals)

- Growth Bucket (business investment, skills, marketing)

Even if all buckets are in one account, you should mentally allocate them.

If you can use multiple bank accounts, even better.

This method works because it removes confusion.

When you know what money is for, you stop spending it twice.

If You Run a Business, Fix Your Cash Conversion Cycle

If you’re a business owner, turn you cash cyclemoneyco around often means something very specific:

Fixing the Cash Conversion Cycle (CCC).

The cash conversion cycle is the time between:

- paying for your costs (inventory, staff, operations)

and - receiving money from customers

If your CCC is too long, you can be profitable and still go broke.

The three parts of CCC:

- DIO (Days Inventory Outstanding)

- DSO (Days Sales Outstanding)

- DPO (Days Payable Outstanding)

To improve cash flow, you want:

- lower DIO

- lower DSO

- Higher DPO (without damaging relationships)

Practical ways to improve business cash flow fast:

- invoice immediately (same day)

- shorten payment terms (Net 7 instead of Net 30)

- offer a small discount for early payment

- charge late fees (even if you rarely enforce them)

- Take partial payments upfront

- Use recurring billing

- Follow up on invoices weekly

Even a single change can dramatically improve your cash cycle.

Make Income More Predictable (The Real Secret)

The biggest reason people can’t turn their cash cycle around is unpredictability.

If income is inconsistent, budgeting feels impossible.

So the goal becomes:

Make income predictable enough to build a stable cash cycle.

If you’re salaried:

- Align bill due dates with payday

- automate transfers into buckets

- pay yourself first (buffer + savings)

If you’re freelance / self-employed:

- create a “minimum baseline income” target

- Stabilize with retainer clients

- Invoicing weekly instead of monthly

- Build a 2–4 week buffer before scaling

If your income is inconsistent, the cash buffer becomes even more important.

Stop Using Debt as a Cash Flow Tool

Many people use debt as a cash flow bridge:

- credit cards for groceries

- buy-now-pay-later for essentials

- loans for bills

This creates a toxic cycle where cash is always behind.

To turn you cash CycleMoneyCo around, you must break this pattern gradually.

A realistic strategy:

- Build a small buffer

- Pay minimums on everything

- Attack the highest-interest debt

- Avoid new debt

- Use the buffer to prevent emergencies from becoming debt

The goal is not perfection. The goal is control.

Use the Money Cycle Reset”Weekly

The CycleMoneyCo approach works best when it’s not a one-time thing.

Do a weekly reset.

Your weekly money reset (10 minutes):

- check balances

- List bills due

- plan spending

- review leaks

- decide on one improvement for next week

This is what separates people who stay stable from people who constantly restart.

Common Mistakes People Make When Trying to Turn Their Cash Cycle Around

Even smart people make these mistakes:

Focusing only on cutting spending

Cutting helps, but cash flow improves more when you increase predictability and fix timing.

Saving too aggressively too early

If saving makes you miss bills, you’ll end up back in debt. Build stability first.

Not separating personal and business cash

This is one of the biggest cash flow killers.

Waiting for “more money”

More money won’t fix a broken cash cycle. A better system will.

Final Thoughts: Turn You Cash CycleMoneyCo Around Starting Today

If you’ve been stuck in the same financial loop for months or years, it can feel like nothing will change.

But the truth is:

Cash flow improves when your system improves.

To turn you cash cyclemoneyco around, focus on these key moves:

- track weekly, not monthly

- stop leaks

- build a mini buffer

- separate money into buckets

- Stabilize income timing

- improve invoice/payment speed (for business owners)

- reset weekly

You don’t need perfection. You need momentum.

Once you build a healthier cash cycle, everything gets easier: bills, savings, debt payoff, and even peace of mind.

FAQs

Is turn you cash cyclemoneyco around a real finance term?

Not officially, but it’s commonly used online to describe improving cash flow habits and money cycles. The closest real business term is the cash conversion cycle.

Can this help if I’m living paycheck to paycheck?

Yes. The fastest wins are stopping cash leaks, building a small buffer, and tracking weekly cash flow.

What if I have inconsistent income?

Then the buffer + weekly planning approach becomes even more important. You’re building stability in a system that naturally feels unstable.

You May Also Read: Gomyfinance.com create budget: A Complete Step-by-Step Guide to Smarter Money Management