Branch vs. Transit Number: What’s the Difference?

When navigating the world of banking, you may come across terms like “branch number” and “transit number” while setting up transactions, especially in Canada. While they might seem like interchangeable terms, they each serve distinct purposes and are crucial for ensuring that your money flows smoothly in the banking system. Understanding the differences between branch and transit numbers can help you ensure that your financial transactions are executed correctly. Let’s dive deeper into these two important elements of the banking system.

What Is a Branch Number?

If you ever think is branch number the same as transit number, a branch number is a unique identification code that banks use to locate and identify specific branches within their network. It is also known as the branch code or branch identifier. This number is critical for differentiating between branches of the same financial institution. For instance, if two branches of the same bank are located in different cities, each branch will have a distinct branch number to ensure that transactions are routed to the correct location.

The branch number is typically made up of three digits. It is used in combination with the transit number and other identifiers, such as your account number, to facilitate transactions like direct deposits, bill payments, wire transfers, and other banking activities.

In Canada, branch numbers are primarily used to identify the physical location of your bank branch. However, in other countries, similar codes may be used to determine the bank’s regional or local network for routing purposes.

What Is a Transit Number?

The transit number is a nine-digit code used in the Canadian banking system to uniquely identify a financial institution and its branch. While it is closely related to the branch number, it serves a more specific purpose. The transit number combines the bank’s institution number (which identifies the financial institution itself) with the branch number (which identifies a specific branch).

The structure of a transit number can be broken down into the following:

- Institution Number: The first five digits of the transit number identify the financial institution. Each bank or credit union has its own unique institution number.

- Branch Number: The last three digits of the transit number represent the specific branch within that financial institution. This helps the banking system route the transaction to the appropriate branch.

In some cases, banks may use the term “transit number” interchangeably with “branch number,” but it’s important to recognize that transit numbers often refer to the entire code, including both the institution and branch number.

The transit number plays an essential role in ensuring that deposits, transfers, and payments are processed correctly by guiding the banking system to the correct financial institution and branch. This is especially important when initiating electronic payments, like wire transfers or setting up payroll deposits, as these transactions require an accurate transit number to be processed efficiently.

Key Differences Between Branch Number and Transit Number

While thinking about how to write a cheque in Canada, both the branch and transit numbers are used to identify the location of a bank or its branch, there are several critical differences that can help you understand their distinct roles.

1. Definition:

- A branch number is a unique identifier for a specific branch of a bank. It identifies the physical location of the bank within a financial institution’s network.

- A transit number is a combination of the institution number and the branch number. It’s used for routing payments and deposits to the correct bank and branch.

2. Structure:

- The branch number is a three-digit code that refers to a particular branch.

- The transit number is a nine-digit code, where the first five digits identify the financial institution (institution number), and the last three digits identify the branch (branch number).

3. Purpose:

- The branch number helps differentiate branches within the same bank, but it’s only one component of the larger transit number.

- The transit number is used for routing transactions, such as electronic payments, to the right institution and branch. It is vital for ensuring that deposits, wire transfers, and bill payments are processed correctly.

4. Usage:

- A branch number is used when identifying a specific branch in a smaller scope of banking activities.

- The transit number is used in wider financial transactions like direct deposit, online transfers, and bill payments. It is also the key to ensuring that money is sent to the correct bank and branch.

5. Format:

- The branch number is typically a three-digit number (e.g., 123).

- The transit number is a longer, nine-digit number (e.g., 12345-123).

Where Are These Numbers Used?

Both branch and transit numbers are used frequently in day-to-day banking. They appear on various documents and transaction forms, including:

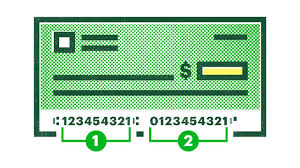

- Cheques: Both the branch number and transit number are printed on the bottom of Canadian cheques. The branch number is typically located near the left side, while the transit number follows the institution number.

- Direct Deposits: Employers and organizations often request your branch and transit numbers to set up direct deposit payments, ensuring your salary or other payments are sent to the correct bank and branch.

- Wire Transfers: When sending or receiving money via wire transfer, the sender will need to provide the transit number to direct the transfer accurately to the receiving bank and branch.

- Online Banking: When setting up online payments, bill payments, or recurring payments, banks may require the transit number to ensure your transaction reaches the correct location.

How to Find Your Branch and Transit Numbers

If you need to find your branch and transit numbers, there are several places to check:

- Cheque Book: As mentioned earlier, both numbers are printed at the bottom of your cheques. The branch number is usually found near the leftmost part, while the transit number follows.

- Bank Statements: Some banks may include the transit and branch numbers on your account statements, typically under account details.

- Online Banking: Many online banking platforms have a section where you can view your transit and branch numbers along with other account information.

- Banking Customer Service: If you’re unsure where to find your branch or transit numbers, you can always call your bank’s customer service department for assistance.

Conclusion

Understanding the difference between a branch number and a transit number is essential for ensuring that your financial transactions are processed smoothly. While both numbers are used in banking to identify locations within a bank’s network, the transit number plays a more vital role in routing payments, deposits, and transfers. Knowing where to find these numbers and how they work can help you avoid errors when setting up payments, transfers, or other banking activities. Whether you’re setting up direct deposits or sending a wire transfer, ensuring you use the correct branch and transit numbers will help prevent delays and ensure the accuracy of your transactions.