Simple Budgeting Tips to Boost Your Retirement Fund

Part of every holistic financial portfolio is a retirement fund. How much money you want in yours when you’re ready to stop working is a personal decision. Many experts suggest aiming for 70-80% of your pre-retirement income for your current standard of living, and then adjusting for cost-of-living projections (as explained in this article by OJM Group).

However, funding it doesn’t have to mean dropping thousands of dollars at a time into a bank account and hoping it, plus Social Security and your 401(k), adds up to enough to see you through your Golden Years. Instead, using these simple budgeting tips can be exactly what you need to boost your retirement fund.

1. Think Before You Spend: This or That?

Every dollar matters when you’re not bringing in a steady paycheck anymore. One way to stretch your retirement budget is to fund it while you’re working with money you don’t need to spend. But if your discretionary income is tight, it’s time to take a deeper look at where your money is going.

Before you splurge on that cup of specialty coffee or a dinner out (plus drinks and tip), make it a habit to ask yourself if you want this or that? Would the money you were going to spend be better served on the splurge or going into your retirement fund?

Sometimes, the answer will be a splurge, and that’s okay. However, asking yourself the question may occasionally — or frequently — change your mind from spending to saving. This works especially well when you give it a target: “Instead of buying an $8 coffee today, this money is going into savings to buy me a cappuccino in Europe when I retire!”

2. Dig Into Your Budget

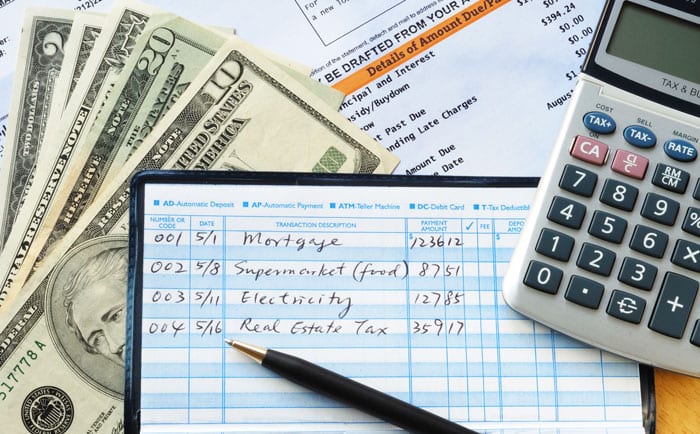

Cutting spending on extras can add up to hundreds of dollars or more each year. Getting proactive with your budget does the same thing when you are more strategic with your expenses.

Budgeting means having a plan for where your money goes. Some people use the 50/30/20 rule (50% to needs, 30% to wants, and 20% to savings). Others make a unique budget designed for their situation. Whatever works for you is fine. The key is to ensure you know where every dollar you make is allocated, and that you’re not wasting any money on unnecessary expenses.

One way to boost your retirement fund is to cut back on your monthly bills. Start by making a list of your essentials (needs). Are there any areas that could be reduced, such as a phone or internet plan or insurance? Shopping around could get you a better deal, and, as the famous gecko says, “save you hundreds of dollars per year.”

3. Pay Off Debt

To spend or to save? That’s a great question. Some people assume they need to fund retirement while paying off credit cards. Yet, if you’re gaining 4% annual interest but paying 24% on your credit cards, you’re taking a loss. Instead, use the money you were going to invest to pay off any high-interest debt first. Then, you can take what you were using on minimum monthly payments and stash it into investments, giving you more bang for your dollar.

If you have any major purchases on the horizon, try to save up for them instead of taking out loans. Put the money into an emergency fund, then replace the savings as soon as you can. The less debt you take with you into retirement, the further your dollars stretch.

4. Increase Your Retirement Contributions

Does your employer match your 401(k) investments? Be sure to take advantage of this by maxing out your contributions as much as possible. Not only will this give you “free” money to accrue in your retirement account, but it also helps reduce your taxable income.

Consider investing in an IRA outside of the employer plan. This lets you save up to $6,500 per year in a tax-deferred plan. You’ll be improving your retirement budget while paying less in taxes on your current year’s income. In some cases, this investment could put you in a lower tax bracket, effectively paying for itself with the tax money it saves you from owing.

Increasing your retirement plan contributions doesn’t need to be a major expense. A few dollars per paycheck adds up quickly when it’s matched by your employer. And if you’re self-employed, there are retirement plan options for you, like the Solo 401(k).

Conclusion

You have a retirement fund, but you want to boost it as much as possible while you’re still earning money. It’s a good plan, but how can you do it without a second or third job? From the 50/30/20 rule to maximizing your contributions for “free” money, these budgeting tips can help you enjoy your life today while saving for a financially stable retirement tomorrow.