AI In Portfolio Management: Enabling Data-Based Investment Success

Introduction

The financial landscape is changing, and AI-driven portfolio management is at the frontline of revolution. Traditional portfolio strategies are losing their capablities, as many companies simultaneously face overwhelming data, slow decision-making processes, and unpredictable market fluctuations. For tackling this challenges, AI-based system has steped into it by providing analysis to huge datasets in real-time, finding hidden patterns, and optimizing investment strategies in an impeccable manner.

AI in portfolio management has become a boon in the financial sector, especially for doing predictive analysis, seeing trends in the market, and adjust their portfolios accordingly in real-time. Not only does AI help to build efficiency, but it also ensures that manual labor and operational expenses are drastically reduced. With mounting competition, adopting AI technology is now a necessity rather than a choice. Read on the blog to learn more…

What Is All About AI in Portfolio Management

Artificial intelligence for portfolio management uses high-tech algorithms, machine learning, and data analytics to make optimal investment choices. It handles enormous financial data in real-time to detect trends, forecast risks, and optimize asset allocation with accuracy. On the other hand, AI reduces human bias and accelerates decision-making by automating market analysis. It allows adaptive strategies that change in response to market movements, maximizing returns while controlling risks. With AI, investors have greater insights and a competitive advantage in the complex financial environment.

Old-Style Portfolio Management vs. AI-Driven Portfolio Management

Old-Style Portfolio Management

Conventional portfolio management practices depend heavily on human discretion, past experiences, and manual analysis. Investment decisions are thereby made based on historical data, ongoing market trends, and the judgment of financial analysts or fund managers. To create a well-balanced investment portfolio approach, enormous research efforts and an appropriate appraisal mix are required.

Portfolio adjustments occur at preset time intervals, which may overlook significant real-time market opportunities. Human emotional biases and subjective decision-making are other ways in which traditional portfolio management has been known to yield mixed results.

Example: Berkshire Hathaway of Warren Buffett takes a conventional investment approach grounded in fundamental analysis and long-term value investing. The company carefully analyzes financial reports and economic trends before making an investment. Nevertheless, this conventional strategy may struggle to react hastily to volatile, quickly shifting markets such as the 2008 financial crisis, in which drastic reversals called for swift corrective action.

AI-Driven Portfolio Management

AI in portfolio management depends on algorithms that use machine learning, predictive analytics, and real-time data processing to improve investment strategies. This can handle all forms of financial information, such as structured or unstructured data, and reveal patterns in the market that can be predicted with great accuracy.

On the other side AI also helps to quickly reduces the risk of human discrimination through automated risk assessment with real-time adaptive performance monitoring. These portfolio improvements can be obtained at lower costs with time-effective decision-making and data-based investment strategies. Real online AI system portfolio management cuts manual costs and time in Investment portfolio management.

Example: BlackRock’s Aladdin platform, which leverages AI, is a top example of AI-based portfolio management. It continuously monitors global financial markets, analyzing risks and investment opportunities in real-time. Aladdin enables fund managers to make informed decisions, rebalancing portfolios automatically for maximum returns and reduced risks. Its AI-based strategy worked well during the COVID-19 market downturn when it quickly readjusted portfolios to minimize losses.

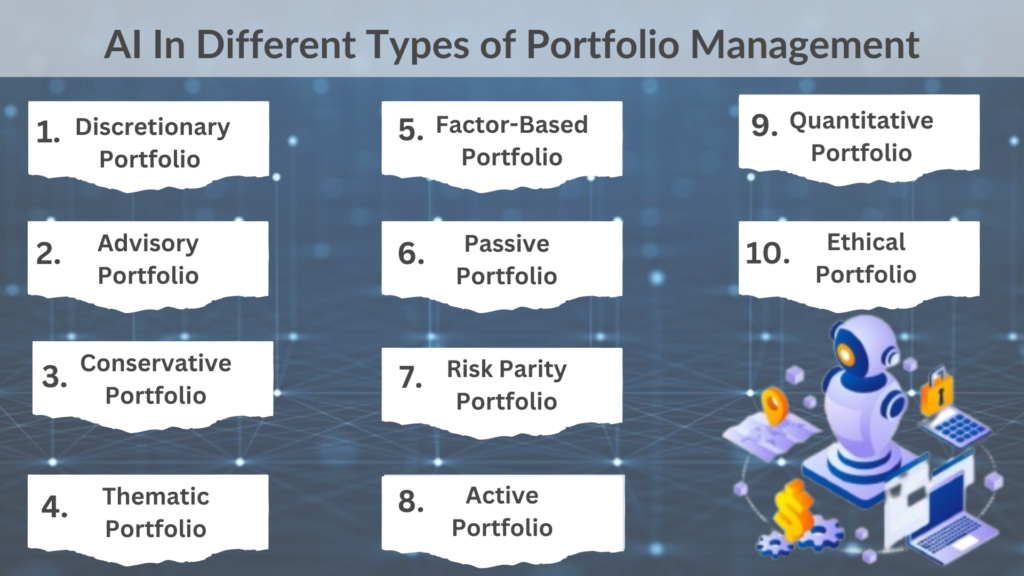

Role of AI in Different Types of Portfolio Management

AI has become a pivotal tool in managing investment portfolios, offering enhanced capabilities in handling complex financial data. Like many business, if you’re looking to refine your strategies, hire AI developers to incorporate advanced solutions that can optimize your portfolio management approach. This integration allows investors to adopt more effective methods, improving overall decision-making and resource allocation. You will get a better idea about AI in portfolio management from the belowgiven types:

1. Discretionary Portfolio Management

Under this strategy, portfolio managers enjoy total freedom to invest on behalf of the clients, tailoring approaches to risk tolerance and investment objectives. Success is dependent on the manager’s experience, yet traditional techniques may be labor-intensive and biased.

AI revolutionizes discretionary management by analyzing enormous amounts of financial information to create customized investment strategies. It analyzes investor profiles, market conditions, and asset performance to make informed decisions. AI also adjusts in real-time, dynamically adjusting portfolios to take advantage of new opportunities while controlling risks.

2. Advisory Portfolio Management

This model offers expert guidance and recommendations to investors while allowing for ultimate decision-making power. Human research-based traditional advisories may be false in dynamic markets.

Conversely, AI-driven guide tools screen global trends, risk factors, and financial data to provide real-time, fact-driven guidance. AI in portfolio management can interpret financial reports, economic indicators, and social sentiment due to natural language processing to give more thought-through advice. Robo-advisors based on AI augment investor assistance by serving automated yet modifiable guidance.

3. Conservative Portfolio Management

This strategy values stability and long-term, consistent returns through low-risk investments like bonds and index funds. Such investors aim to conserve capital over the desire to optimize short-term returns. The challenge comes in choosing the correct assets that yield consistent returns with minimal market volatility.

AI improves conservative portfolio management through examination of past market trends and determination of low-volatility investments. Machine learning algorithms evaluate economic metrics to forecast downturns and enable risk-adjusted asset choice. AI tools also automate rebalancing of portfolios to align with market conditions while preserving long-term stability.

4. Thematic Portfolio Management

This approach is about investing in long-term themes like sustainability, technology, or healthcare developments. Conventional thematic investing involves extensive research to determine high-potential trends.

AI recognizes new investment opportunities through the study of industry trends, consumer trends, and geopolitical events. Sentiment analysis software reads news stories and financial reports to identify changes in market sentiment. AI also evaluates the long-term sustainability of thematic investments so that portfolios remain in line with changing global trends.

5. Factor-Based Portfolio Management

Factor-based investing refers to the process of constructing portfolios on the basis of underlying characteristics such as value, momentum, quality, or volatility. Traditional factor-based methods rely on historical data, which can be deceptive when used to forecast future performance.

AI models complement factor-based management by identifying relationships between different factors and approximating their impact on portfolio returns. Machine learning models assess macroeconomic settings and asset trends, facilitating adaptive factor allocation. AI continuously revises factor weightings to achieve maximum returns with managed risks.

6. Passive Portfolio Management

Passive investing seeks to match the performance of a particular market index or benchmark with reduced costs and trading. Conventional passive strategies involve periodic rebalancing, which may not always be in sync with market movements.

AI improves passive portfolio management by maximizing index tracking and minimizing tracking errors through real-time rebalancing. AI programs rebalance automatically by constantly monitoring price movements and weight adjustments in benchmark indices. This keeps portfolios closely tracking their respective indices with minimal human intervention.

7. Risk Parity Portfolio Management

This approach weighs assets by their risk contribution instead of conventional capital weighting. The key is striking a balance of risk exposure among asset classes during times of uncertain market conditions.

Risk parity models powered by AI evaluate market uncertainty, correlations among assets, and risk-adjusted returns in real-time. They employ deep learning algorithms to model potential market scenarios and recalibrate allocations accordingly. AI also improves stress testing capabilities, keeping portfolios robust even during periods of market stress.

8. Active Portfolio Management

Active management involves constant buying and selling of holdings to beat market benchmarks. Traditional techniques are based on huge amounts of research, fundamental analysis, and investor intuition, with high transaction costs.

AI enhances active portfolio management by predicting short-term trading opportunities using real-time data analysis. High-frequency trading (HFT) algorithms place trades in milliseconds using AI-driven insights. AI also picks up on market trend anomalies, allowing fund managers to make more informed investment choices.

9. Quantitative Portfolio Management

This methodology is based on mathematical models and statistical calculations to build and maintain portfolios. Traditional quantitative techniques involve manual model tweaks, which may go out of sync in rapidly evolving markets.

Quantitative models driven by artificial intelligence increase accuracy through constant updating of investment algorithms. Machine learning recognizes extremely large data sets to identify latent market trends and forecast asset price behavior. AI also enhances risk modeling by including non-conventional data feeds like social media sentiment and alternative financial metrics.

10. Ethical Portfolio Management

Ethical Portfolio Management filters investments based on moral values, excluding companies involved in controversial activities like weapons, tobacco, or human rights violations. It uses positive screening to choose firms showing excellent ethical conduct, transparent management, and positive social contributions. This approach balances financial returns with moral considerations, often using specialized ethical indices as benchmarks. Modern ethical management uses AI to review corporate ethics through intricate global supply chains and pinpoint future ethical hazards.

Uses of AI in Managing Investment Portfolios

1. Factor Analysis for Astute Investing

AI analyzes investment drivers such as value, momentum, and volatility based on historical data to optimize asset allocation. AI detects hidden patterns and associations, enhancing investment choices. Machine learning improves factor-based strategies as it continuously refines predictions.

2. Real-Time Market Monitoring

AI scans real-time market information, news, and investor sentiment for trends and risk in real-time. It allows portfolio managers to respond promptly to changes in the market, thereby minimizing losses. Ongoing tracking ensures investments continue to be adjusted according to current market conditions.

3. Scenario-Based Risk Assessment:

AI generates market simulations to forecast investment returns under varied economic scenarios. Investors can craft risk-reducing strategies by using real-time and historical information. It aids in stress-testing portfolios against potential declines.

4. Adaptive Hedging Strategies:

AI keeps a constant watch on market trends to dynamically adjust hedging positions. It reduces risks of losses by detecting losses early and optimizing protective strategies. This maintains portfolio stability in fluctuating markets.

5. Portfolio Optimization:

AI-based models evaluate risk-reward ratios to build well-balanced investment portfolios. They learn and adjust according to market trends and investor objectives, providing the optimal asset mix. Sophisticated algorithms optimize decision-making for long-term portfolio development.

6. Automated Trade Execution:

AI makes trades based on forecasting models and pre-programmed investment criteria, eliminating human bias. It studies past trends to time trades for the highest returns. Automated execution eliminates inefficiency and minimizes cost of transactions.

7. Tax-Efficient Investing:

AI detects tax-saving techniques by examining investment holdings and relevant tax regulations. It maximizes capital gains realization and tax-loss techniques to generate the highest after-tax returns. This helps investors keep more in their pockets while staying within rules.

8. Cash Flow Forecasting

AI forecasts future cash requirements based on past financial information and live market intelligence. It maintains liquidity while optimizing investment proportions. This avoids cash shortages and maximizes possible returns.

Conclusion:

Artificial intelligence is transforming portfolio management with the ability to make data-driven choices, compute risks in real time, and choose optimal investment strategies. Companies utilizing AI achieve a competitive advantage with more intelligent asset allocation and less operational waste. The potential for analyzing huge volumes of data, anticipating market directions, and executing automated trades significantly improves portfolio performance. Most companies would rather engage in AI agent development services since it enables them to deploy smart automation, digitize financial operations, and enhance investment accuracy. As time goes on, the role of AI in portfolio management will become increasingly crucial for forward-thinking financial strategies.