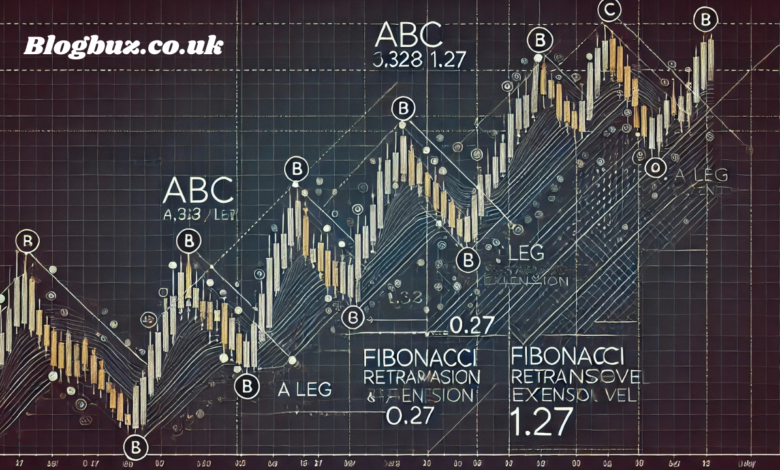

ABC .328 1.27 Pattern: A Deep Dive into Fibonacci Ratios for Accurate Market Analysis

Patterns and ratios are essential in predicting market trends and price reversals in technical analysis. One pattern that has captured novice and seasoned traders’ attention is the ABC pattern with Fibonacci ratios of .328 and 1.27. Unlike traditional ABC structures, this variant incorporates unique Fibonacci levels that add precision to trading decisions, making it a powerful tool in markets ranging from stocks and forex to cryptocurrency. This article will help you understand the ABC .328 1.27 pattern, explore its structure and application in trade, and offer helpful advice for integrating it into your trading strategy.

What is the ABC Pattern?

The ABC pattern is a familiar technical analysis pattern traders utilize to spot possible trend reversals. This trend comprises three segments or “legs”—the A leg, B leg, and C leg—which signify different stages in market movements. The ABC pattern is traditionally used to predict corrective trends, allowing traders to anticipate when a price trend may reverse. However, the ABC .328 1.27 pattern is more nuanced and incorporates specific Fibonacci levels, enhancing its predictive accuracy.

Understanding the Fibonacci Ratios: .328 and 1.27

The mathematical formula known as the Fibonacci sequence has broad applications in nature, science, and finance. Specific Fibonacci ratios, like .328 (32.8%) and 1.27 (127%), are used in this pattern to define price retracement and extension levels. These specific levels give traders key points to anticipate either a continuation or reversal of the trend, helping them make more precise entries and exits.

The .328 Fibonacci Level

The .328 level, representing 32.8% retracement, is a relatively unique application of the Fibonacci ratio. It defines the depth of the B leg about the A leg in the ABC pattern, meaning that traders can consider this level a potential turning point once the price retraces by 32.8% from its initial movement. This partial retracement is critical in the ABC .328 1.27 pattern as it distinguishes itself from more traditional Fibonacci retracement levels like 0.382 or 0.618.

The 1.27 Fibonacci Level

The 1.27 level, or 127% extension, is crucial in forecasting the end of the C leg. This ratio suggests that the C leg will extend 127% of the A leg’s length, completing the corrective pattern and signaling potential trend exhaustion. The 1.27 extension level is a valuable predictive tool for identifying price targets, enabling traders to prepare for a shift back to the primary trend.

Anatomy of the ABC .328 1.27 Pattern

The ABC .328 1.27 pattern is structured in three parts:

- A Leg: The first leg marks an initial move against the primary trend. In a bullish trend, this could be a downward movement, while in a bearish trend, this could represent an upward movement.

- B Leg: Following the A leg, the B leg serves as a corrective retracement, typically retracing by around 32.8% (the .328 Fibonacci level) of the A leg’s distance.

- C Leg: The final segment, the C leg, extends beyond the endpoint of the A leg, usually by 127% (1.27 Fibonacci level), marking the completion of the pattern.

Together, these components provide a predictive framework for price movements and serve as a guide for potential reversals.

Why Traders Prefer the ABC .328 1.27 Pattern

This pattern has become increasingly popular because of its accuracy and adaptability, making it a valuable tool across various financial markets. Here are some reasons why the ABC .328 1.27 pattern is widely adopted:

- Enhanced Accuracy: The .328 retracement and 1.27 extension levels offer precise entry and exit points, helping traders make better decisions.

- Clear Structure: The pattern’s simple A-B-C structure provides clarity, making it accessible even to beginner traders.

- Risk Management: Traders can set stop-loss and take-profit points based on the pattern’s clear retracement and extension targets, allowing them to manage risk more effectively.

- Versatile Application: Whether in forex, stocks, or cryptocurrencies, the ABC .328 1.27 pattern can be used effectively across different asset classes and timeframes.

Practical Application of the ABC .328 1.27 Pattern in Trading

Incorporating the ABC .328 1.27 pattern into your trading strategy involves a systematic approach. Here is a step-by-step guide to applying this pattern:

- Identify the Prevailing Trend: The pattern works best as a corrective structure within a trending market. Determine if there is a bullish or negative trend in the market right now.

- Spot the A Leg: Look for an initial price movement that opposes the primary trend. This move marks the beginning of the A leg.

- Measure the B Leg Retracement: Using a Fibonacci retracement tool, measure the retracement from the end of the A leg. A retracement that aligns with the .328 level confirms that the ABC .328 1.27 pattern may be forming.

- Project the C Leg: Using a Fibonacci extension tool, project the endpoint of the C leg by applying the 1.27 extension. This projection helps you estimate where the price will likely reverse or complete the correction.

- Set Stop-Loss and Take-Profit Points: Use the identified retracement and extension levels to establish stop-loss and take-profit orders. This step helps manage your risk and protect your capital.

- Confirm with Additional Indicators: Complement the pattern using other technical metrics, including moving averages or volume analysis, to confirm the pattern’s validity.

Case Studies: Real-World Applications of the ABC .328 1.27 Pattern

Many traders have successfully used the ABC .328 1.27 pattern in their trading strategies. For instance:

- In Forex Trading: Forex traders use the ABC .328 1.27 pattern to identify potential reversal points in currency pairs. By combining this pattern with other indicators like movers and the Relative Strength Index (RSI) (MA), traders enhance the pattern’s predictive reliability.

- In Stock Markets: Stock traders utilize the ABC .328 1.27 pattern for short-term trades, especially when a stock shows signs of temporary reversal. This pattern is handy for swing trading, where traders look for retracements within broader trends to make quick profits.

- In Cryptocurrency: Given the volatile nature of cryptocurrencies, the ABC .328 1.27 pattern offers a structured approach to trading in these markets, helping traders capitalize on price corrections and avoid potential market reversals.

Tips for New Traders Using the ABC .328 1.27 Pattern

- Familiarize Yourself with Fibonacci Ratios: Understanding how Fibonacci levels work is critical to effectively using the ABC .328 1.27 pattern.

- Use Reliable Charting Software: Tools like TradingView and MetaTrader provide accurate Fibonacci tools, making it easier to measure retracements and extensions.

- Combine with Other Indicators: Enhance the pattern’s effectiveness by confirming signals with additional technical indicators.

- Start Small: Begin applying this pattern in small trades until you become comfortable with its setup and interpretation.

- Analyze Different Timeframes: The ABC .328 1.27 pattern is flexible across multiple timeframes, from intraday trading to weekly trends, so practice analyzing it within different contexts to build a robust understanding.

Common Misconceptions and Challenges

There are a few misconceptions about the ABC .328 1.27 pattern:

- It’s Not a Guarantee: No pattern can guarantee success. The ABC .328 1.27 pattern provides signals but requires further analysis to make reliable decisions.

- Applicability Across All Markets: Although versatile, the pattern is unsuitable for every market condition, especially in highly volatile or directionless markets.

- Precision in Fibonacci Levels: Achieving accuracy with the .328 and 1.27 levels requires practice and familiarity with charting tools.

Conclusion

The ABC .328 1.27 pattern is a sophisticated tool for traders seeking to enhance their technical analysis skills. By understanding its structure, Fibonacci-based retracement and extension levels, and practical applications, traders can use this pattern to forecast potential trend reversals and manage risk more effectively. With practice, this pattern can become a valuable component of any trading strategy, providing insights into price movements and helping traders make well-informed decisions in dynamic markets.

You May Also Read: Why https://onlypc.net is the Best Platform for Trading Education and Risk Management