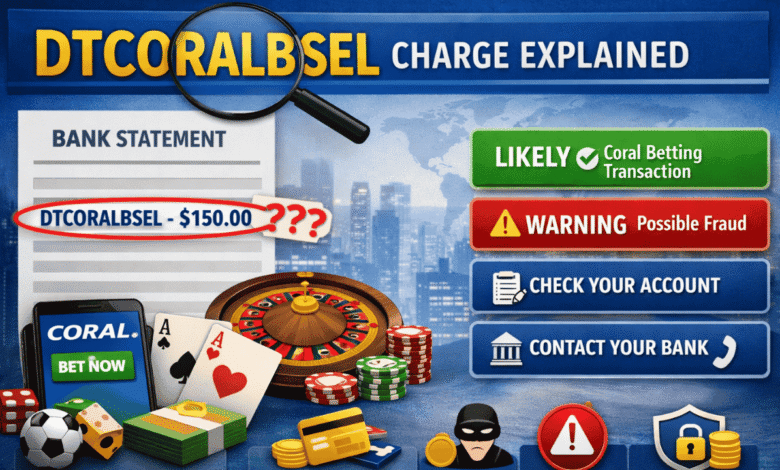

DTCORALBSEL on Your Bank Statement: Causes, Safety, and Next Steps

If you recently checked your bank statement and noticed a charge labeled dtcoralbsel, you are not alone. This term is searched for by thousands of individuals each month after spotting it on their debit or credit card transactions. At first glance, it looks confusing, technical, and even suspicious. This article explains what dtcoralbsel means, where it comes from, why it appears on your bank statement, whether it is safe, and what steps to take if you do not recognize the charge.

What Is DTCORALBSEL?

DTCORALBSEL is a bank transaction descriptor. It is not a product name, company brand, or software tool that customers usually interact with directly. Instead, it is a shortened label used by payment processors and banks to identify a specific type of transaction.

In most cases, dtcoralbsel is linked to:

Online betting or gambling transactions associated with the Coral brand (part of the Entain Group).

Banks use short codes like this because transaction descriptions must fit within a limited character space on statements.

Breaking Down the Term DTCORALBSEL

While banks do not publish official definitions for every descriptor, industry analysis and financial reporting suggest the following interpretation:

| DT | Debit Transaction |

| CORAL | Coral (UK bookmaker brand) |

| BSEL | Betting Services / internal billing code |

So, a debit transaction from Coral betting services.

Who or What Is Coral?

Coral is a major UK-based bookmaker founded in 1926 and currently owned by Entain plc, one of the largest gambling companies in the world.

Coral operates:

- Online sports betting

- Casino games

- Poker

- Bingo

- Retail betting shops (UK & Ireland)

If you have ever:

- Deposited money into a Coral account

- Placed online bets

- Used Coral casino services

- Subscribed to betting promotions

Then the dtcoralbsel is very likely related to that activity.

Why Does DTCORALBSEL Appear on Bank Statements?

There are several legitimate reasons why this transaction may show up:

You deposited money into a Coral account

This is the most common reason.

You placed a bet using a debit or credit card

Some bets are processed as separate card transactions.

You used Coral’s mobile app or website

Mobile app transactions often use technical descriptors.

Recurring payments or saved card usage

If your card is saved in your Coral account, deposits can happen quickly and appear unexpected.

Someone else used your card

A family member or partner may have access to your card.

IsDTCORALBSEL Legitimate or a Scam?

In most cases: ✅ Legitimate

The descriptor itself is not a scam. It is widely associated with regulated gambling services operated by licensed companies.

However…

In rare cases: ⚠️ Could indicate unauthorized use

If:

- You have never used Coral

- You do not gamble

- You do not recognize the amount

- Multiple charges appear unexpectedly

Then it may indicate:

- Card theft

- Account compromise

- Unauthorized transactions

How to Check If the Charge Is Legitimate

Follow these steps:

Check your betting accounts

Look for transaction history in:

- Coral

- Other betting platforms (some share processors)

Review the transaction date and amount

Compare with:

- Bank statement

- Email receipts

- Betting confirmations

Ask people with card access

Family members or partners may have used it.

Search your email

Look for messages from:

- Coral

- Entain

- Betting confirmations

What to Do If You Do NOT Recognize DTCORALBSEL

If the charge is unfamiliar:

Contact your bank immediately

Tell them the transaction descriptor: DTCORALBSEL

They can:

- Verify merchant details

- Freeze your card if needed

- Start a chargeback

Change your banking passwords

Especially if you use online banking or mobile apps.

Cancel your card if fraud is suspected

Banks will issue a replacement.

Report to Coral support (optional)

They can confirm whether your card number appears in their system.

Can DTCORALBSEL Appear Internationally?

Yes.

Although Coral is UK-based, transactions may appear in:

- Europe

- Australia

- Asia

- Online international accounts

Because payment processors route transactions globally.

Common Variations of DTCORALBSEL

You might also see:

- DT CORAL BSEL

- DTCORAL BSEL

- CORALBSEL

- CORAL INTL

- CORAL DEPOSIT

All usually point to the same source.

Is DTCORALBSEL a Subscription?

Usually no.

Most transactions are:

- One-time deposits

- Betting charges

However, some gambling platforms allow:

- Auto-deposits

- Promotional subscriptions

Always check your betting account settings.

Legal and Regulatory Status

Coral operates under:

- UK Gambling Commission license

- Gibraltar / international gaming authorities (historically)

This means:

- Transactions are regulated

- Consumer protection rules apply

- Disputes can be investigated

Why the Descriptor Looks So Strange

Bank descriptors are limited to about 18–22 characters.

Instead of showing:

Coral Interactive (Gibraltar) Limited – Online Betting Deposit

The system shortens it to:

DTCORALBSEL

This is why it appears cryptic.

FAQs About DTCORALBSEL

What does dtcoralbsel mean on my bank statement?

It usually means a debit transaction related to Coral betting services.

Is dtcoralbsel fraud?

Not usually, but investigate if you do not recognize the charge.

Can I get a refund for dtcoralbsel?

Yes, through Coral or your bank if unauthorized.

Is dtcoralbsel safe?

Yes, when linked to legitimate betting activity.

Why does dtcoralbsel keep appearing?

You may have recurring deposits or frequent betting activity.

How to Prevent Unexpected Charges in the Future

- Do not save cards on betting websites

- Enable bank transaction alerts

- Set spending limits

- Use virtual cards for gambling

- Enable two-factor authentication

Final Thoughts

DTCORALBSEL is not malware, software, or a virus. It is simply a bank transaction label, most commonly linked to Coral online betting services.

While the charge is usually legitimate, you should always verify any unfamiliar transaction. Quick action with your bank can prevent financial loss if fraud is involved.

Understanding transaction descriptors like dtcoralbsel helps you remaining in charge of your finances and avoiding unnecessary expenses panic when reviewing your statement.

You May Also Read: Coyyn Com Banking App: Redefining the Future of Digital Banking