How Accounting Practice Management Software Improves Client Collaboration

Accounting firms today face increasing workloads, tighter regulations, and growing client expectations. Managing multiple financial tasks manually can be time-consuming and prone to errors. This is where accounting practice management software plays a crucial role. These software solutions are designed to streamline workflow, automate routine tasks, and improve collaboration between accountants and clients.

From tracking client records to managing invoices, time tracking, and document storage, these tools provide a centralized platform for accounting firms. The right accounting practice management software not only improves efficiency but also enhances accuracy, ensuring compliance with industry standards. By automating redundant tasks, accountants can focus on delivering high-value financial services instead of administrative burdens.

Features of Accounting Practice Management Software

Workflow and Task Automation

One of the biggest advantages of using practice management software is automation. Accountants can automate recurring tasks such as tax filings, client reminders, and financial reporting, reducing manual errors and saving time.

Centralized Client Management

Keeping track of multiple clients and their financial records can be challenging. These software solutions provide a centralized system where all client data, communication history, and documents are stored securely and easily accessible.

Time Tracking and Billing Integration

Many accounting firms charge clients on an hourly basis. Built-in time tracking and billing features help firms accurately record work hours, generate invoices, and ensure timely payments without additional manual work.

Secure Document Storage and File Sharing

With cloud-based access, accountants can store, organize, and share important financial documents securely. Encryption and multi-layer security ensure client confidentiality and regulatory compliance.

Collaboration and Team Communication

Accounting practice management software enables seamless communication between team members. Whether working remotely or in-office, accountants can assign tasks, track project progress, and share updates effortlessly.

Compliance and Regulatory Support

Financial regulations require firms to maintain records and comply with tax laws. These software solutions come with compliance tracking features, ensuring firms adhere to the latest legal and industry requirements.

Best Accounting Practice Management Software Options

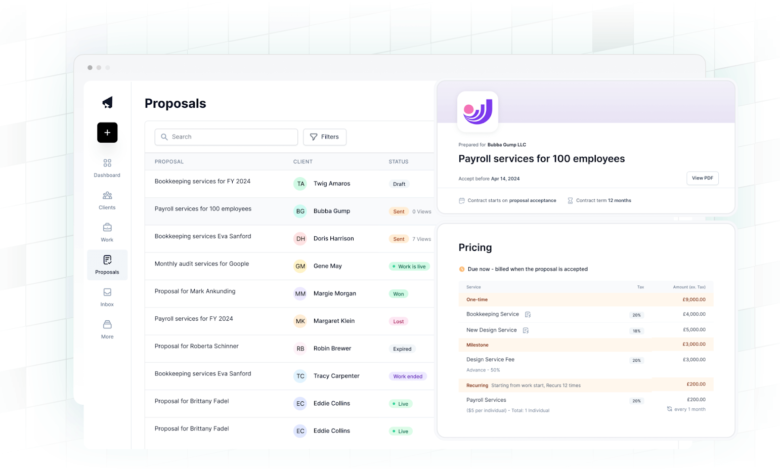

1. Cone

Cone is a modern accounting management tool designed for workflow automation, financial reporting, and seamless client collaboration.

2. Sage Intacct Accountants Program

This cloud-based solution offers robust financial management features, automating invoicing, tax calculations, and multi-client management.

3. Karbon

Karbon provides end-to-end task management, client communication tracking, and workflow automation for accounting professionals.

4. Jetpack Workflow

Ideal for small to mid-sized firms, Jetpack Workflow simplifies project tracking, automated client follow-ups, and deadline management.

5. Canopy

Canopy offers tax resolution, document storage, and an integrated CRM system, making client management effortless for accountants.

6. TaxDome

This platform combines document management, client portals, and invoicing tools, providing an all-in-one solution for accounting firms.

7. Aero Workflow

Aero Workflow focuses on structured task management and ensures accountants can maintain high efficiency with automated scheduling.

8. Financial Cents

With an easy-to-use interface, Financial Cents helps firms track client projects, manage deadlines, and streamline communication.

9. Pixie

Designed for small accounting firms, Pixie offers an intuitive dashboard for managing tasks, deadlines, and client interactions.

10. Mango Practice Management

Mango simplifies accounting processes with its smart automation, invoicing, and secure document-sharing features.

11. Firm360

A cloud-based practice management software that helps firms manage tasks, automate workflows, and improve efficiency.

12. Senta

Senta provides compliance tools, automated task scheduling, and a powerful CRM system for accounting firms.

How to Choose the Right Accounting Practice Management Software

Selecting the right accounting practice management software depends on several factors, including firm size, budget, and specific needs. Here are some key points to consider:

Scalability: Ensure the software can grow with your firm and handle increasing workloads.

Integration Capabilities: Look for software that integrates with existing accounting tools such as QuickBooks or Xero.

User-Friendly Interface: A simple and intuitive design improves efficiency and reduces the learning curve for your team.

Security Features: Given the sensitive nature of financial data, ensure the software offers strong encryption, multi-factor authentication, and data backup.

Customer Support: Reliable customer service is crucial in case of technical difficulties or implementation challenges.

The Future of Accounting Practice Management

As the accounting industry continues to evolve, technology is playing a vital role in enhancing productivity and compliance. Investing in accounting practice management software ensures firms can automate tasks, improve accuracy, and provide better service to clients.

With cloud-based features, AI-driven insights, and improved security, modern accounting software solutions are transforming the way firms operate. Those who embrace these tools early will stay ahead of the competition and build a more efficient, client-focused accounting practice.