Small Business Accounting Software

Managing finances is one of the most critical yet challenging aspects of running a small business. For many entrepreneurs, keeping track of invoices, expenses, taxes, and cash flow can feel overwhelming. That’s where small business accounting software steps in offering a simple, efficient, and affordable solution to streamline your financial management.

Why Do Small Businesses Need Accounting Software?

Gone are the days of manually updating spreadsheets or relying solely on paper records. Today’s accounting software is designed to automate repetitive tasks, reduce human errors, and save time. Whether you’re tracking income, managing expenses, or handling VAT, these tools provide small businesses with the financial clarity they need to thrive.

Features to Look for in Small Business Accounting Software

When selecting accounting software, it’s essential to ensure it aligns with your business needs. Here are some key features to consider:

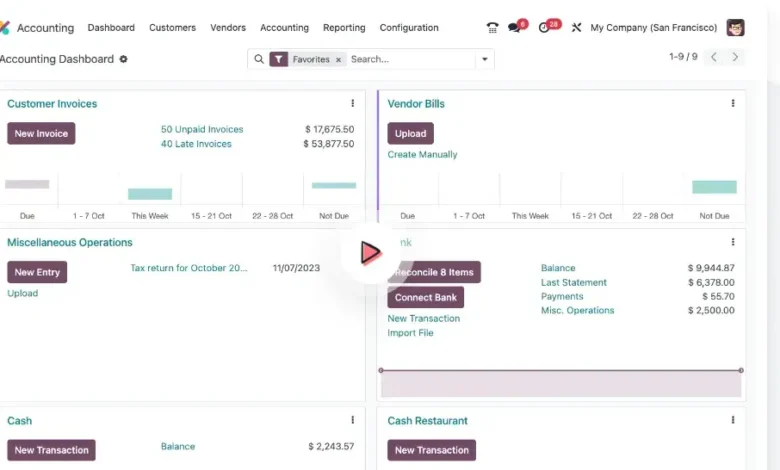

- User-Friendly Interface

Look for software that is easy to navigate, even for non-accountants. A clean, intuitive design can save you time and reduce the learning curve. - VAT and Tax Support

Tax compliance can be a headache for small businesses. Good accounting software should include VAT calculations, tax filing tools, and reminders for upcoming deadlines. - Real-Time Financial Insights

Many platforms provide dashboards with real-time updates on your cash flow, income, and expenses. This helps you make informed decisions on the fly. - Invoicing and Expense Management

Automate invoice generation, track payments, and categorize expenses—all from a single platform. - Cloud Integration

Access your financial data anytime, anywhere. Cloud-based software also ensures your data is securely backed up. - Scalability

Choose a platform that can grow with your business, offering additional features as your needs evolve.

Top Benefits of Using Small Business Accounting Software

- Time Savings: Automate repetitive tasks, allowing you to focus on growing your business.

- Accuracy: Minimize errors in calculations and ensure precise record-keeping.

- Cost-Effectiveness: Affordable plans tailored for small businesses mean you don’t have to break the bank.

- Compliance: Simplified VAT and tax management ensure you stay on top of legal requirements.

- Collaboration: Many tools allow you to share data with your accountant or team members seamlessly.

Popular Small Business Accounting Software Options

There are plenty of great platforms tailored for small businesses. Some of the most popular include:

- Giddh: Known for its comprehensive features, including invoicing, expense tracking, and VAT support.

- Xero: A cloud-based solution with robust reporting and integration capabilities.

- FreshBooks: Best for service-based businesses, with a focus on time tracking and invoicing.

- Zoho Books: Affordable and ideal for small teams with basic accounting needs.

- Wave: Free accounting software with features like invoicing and receipt scanning, perfect for startups.

Final Thoughts

Investing in small business accounting software is a step toward financial clarity and efficiency. It not only helps you manage your daily operations but also sets the foundation for long-term growth. With the right tool, you can save time, reduce errors, and focus on what you do best running your business.

Take the leap and choose an accounting solution that simplifies your finances. Your future self and your bottom line will thank you!

Meta Description: Simple and efficient accounting software for small businesses, offering VAT support, real-time filing, and tools to streamline financial management.