Investiit.com Tips: A Practical Roadmap to Smarter Investing

Investing can feel overwhelming, especially for beginners who are unsure where to start or how to avoid costly mistakes. That is why reliable educational platforms and structured guidance matter more than ever. One resource that has gained attention for simplifying investment concepts is Investiit.com. By applying proven investiit.com tips, investors can build strong foundations, manage risk effectively, and grow their wealth with greater confidence. This article provides a detailed breakdown of the most practical investiit.com tips, explaining how they work, why they matter, and how you can apply them regardless of your experience level.

Understanding the Philosophy Behind Investiit.com Tips

Before diving into specific strategies, it is important to understand the philosophy that drives investiit.com tips. The platform emphasizes education-first investing rather than speculation or shortcuts. Instead of promising quick profits, it focuses on discipline, long-term thinking, and informed decision-making.

At the core of investiit.com tips is the belief that successful investors are made through consistent learning, patience, and risk management. This approach aligns with widely accepted investment principles used by professionals across global markets.

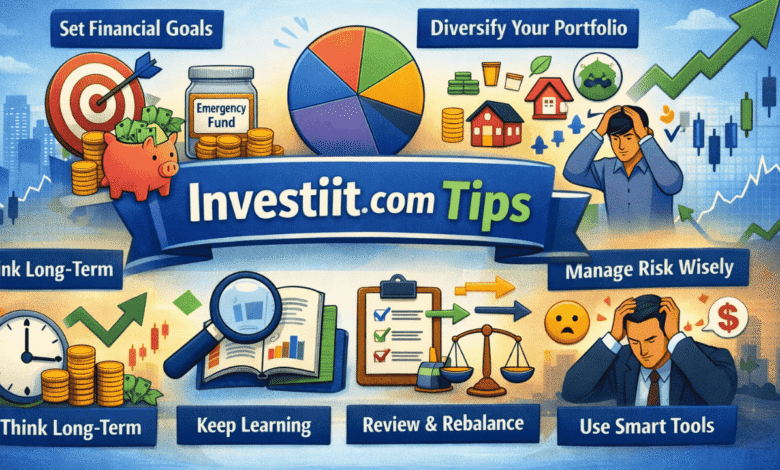

Start With Clear Financial Goals

One of the most repeated investiit.com tips is the importance of setting clear financial objectives. Investing without direction often leads to emotional decisions, unnecessary risks, and inconsistent results.

Financial goals should be:

- Specific (e.g., retirement, buying a home, funding education)

- Time-bound (short-term, medium-term, or long-term)

- Measurable (a defined monetary target)

By identifying your goals early, you can choose investment instruments that match your time horizon and risk tolerance. This clarity helps you stay focused during market volatility and prevents impulsive decisions.

Build a Strong Foundation Before Investing

Another essential principle among investiit.com tips is preparation. Before investing, you should ensure that your financial base is stable.

This foundation includes:

- An emergency fund covering 3–6 months of expenses

- Minimal high-interest debt

- A basic understanding of budgeting and cash flow

Investing without this foundation can force you to sell assets at the wrong time if unexpected expenses arise. A stable base allows your investments to grow without unnecessary pressure.

Diversification Is Not Optional

Diversification is one of the most important investment tips for reducing risk. Instead of putting all your money into a single asset, sector, or market, diversification spreads risk across different investments.

A diversified portfolio may include:

- Stocks from multiple industries

- Bonds or fixed-income instruments

- Real estate or real estate investment trusts (REITs)

- International exposure

Diversification does not eradicate risk entirely, but it significantly reduces the impact of a single poor-performing investment on your overall portfolio.

Learn Risk Management Before Chasing Returns

Many beginners focus only on returns, but investiit.com tips strongly emphasize risk management. Understanding how much risk you can tolerate is just as important as understanding potential rewards.

Risk management strategies include:

- Allocating assets based on risk tolerance

- Avoiding overexposure to volatile investments

- Using stop-loss strategies when appropriate

- Rebalancing portfolios periodically

By prioritizing risk control, investors protect their capital and stay invested long enough to benefit from long-term growth.

Avoid Emotional Investing

One of the most practical investiit.com tips is learning to control emotions. Fear and greed are among the biggest reasons investors lose money.

Common emotional mistakes include:

- Panic selling during market downturns

- Chasing trends or “hot” stocks

- Overtrading due to short-term price movements

Investiit.com tips encourage sticking to a plan, reviewing data objectively, and making decisions based on logic rather than market noise. Emotional discipline often separates successful investors from unsuccessful ones.

Focus on Long-Term Growth

Short-term trading can be tempting, but most investiit.com tips favor long-term investing. Compounding works best when investments are allowed to grow over time without frequent interruptions.

Long-term investing benefits include:

- Lower transaction costs

- Reduced tax impact

- Smoother performance across market cycles

By staying invested for years rather than weeks or months, investors increase their chances of achieving consistent and sustainable returns.

Keep Learning and Updating Your Knowledge

Markets evolve, regulations change, and new investment products emerge regularly. That is why continuous education is a recurring theme in investiit.com tips.

Ways to stay informed include:

- Reading financial news and analysis

- Learning basic financial ratios and metrics

- Understanding macroeconomic trends

- Reviewing past investment decisions

Investing is not a one-time skill but an ongoing learning process. Staying informed allows you to adapt without overreacting.

Review and Rebalance Your Portfolio Regularly

Another valuable investiit.com tip is portfolio review. Over time, some investments may outperform others, causing your asset allocation to drift away from your original plan.

Rebalancing helps:

- Maintain your desired risk level

- Lock in gains from outperforming assets

- Reallocate funds to underweighted areas

Periodic reviews—quarterly or annually—help ensure that your portfolio remains aligned with your goals.

Use Technology and Tools Wisely

Modern investing offers access to platforms, tools, and analytics that were once available only to professionals. Investiit.com tips encourage using these tools to monitor performance, analyze data, and make informed decisions.

However, tools should support decision-making—not replace critical thinking. Relying blindly on algorithms or trends can be just as risky as ignoring data altogether.

Conclusion: Why Investiit.com Tips Matter for Every Investor

The investing journey is filled with uncertainty, but the right guidance can make it far more manageable. By following proven investiit.com tips, investors can avoid common pitfalls, manage risk effectively, and build sustainable wealth over time.

You May Also Read: Invest1NOW.com Stocks: Your Gateway to Smart Stock Market Investing